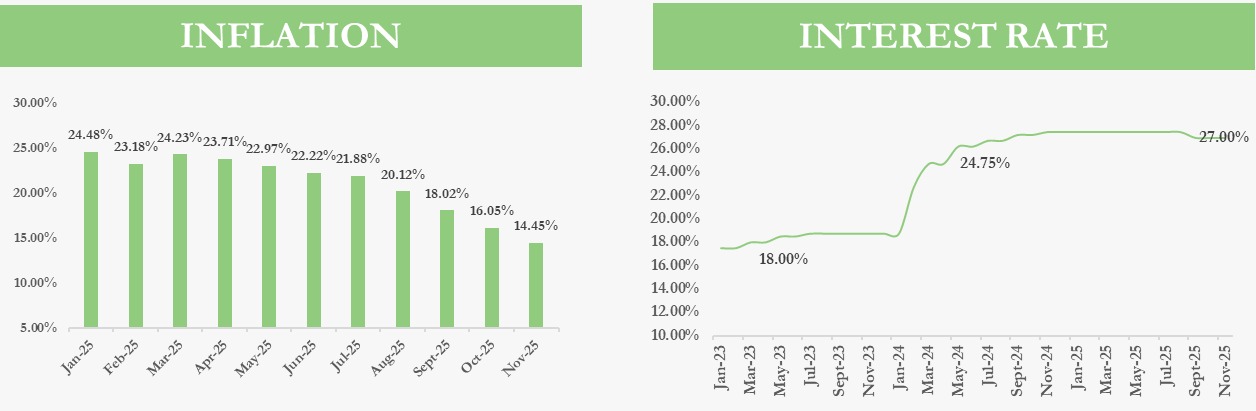

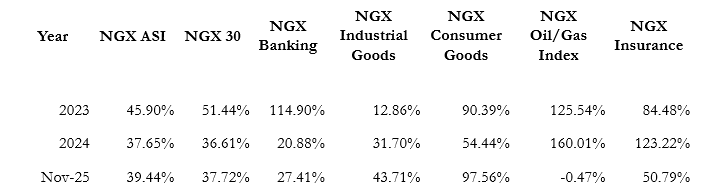

Inflation eased to 15.15% in December 2025 following an adjustment by the NBS.

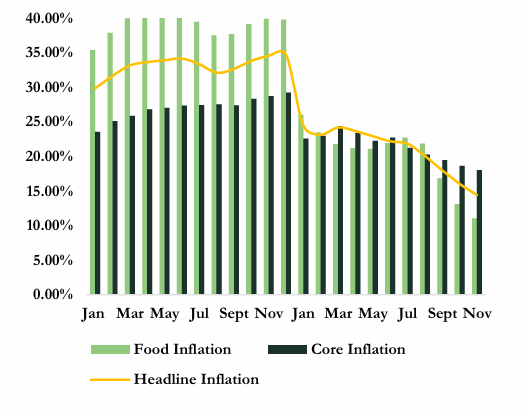

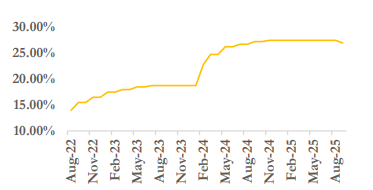

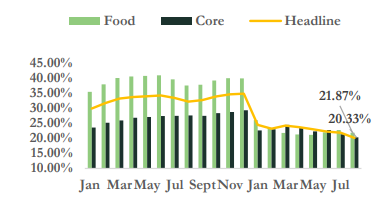

Nigeria’s headline inflation moderated to 15.15% year-on year in December 2025, down from 17.33% in November, reflecting a methodological adjustment by the National Bureau of Statistics (NBS).

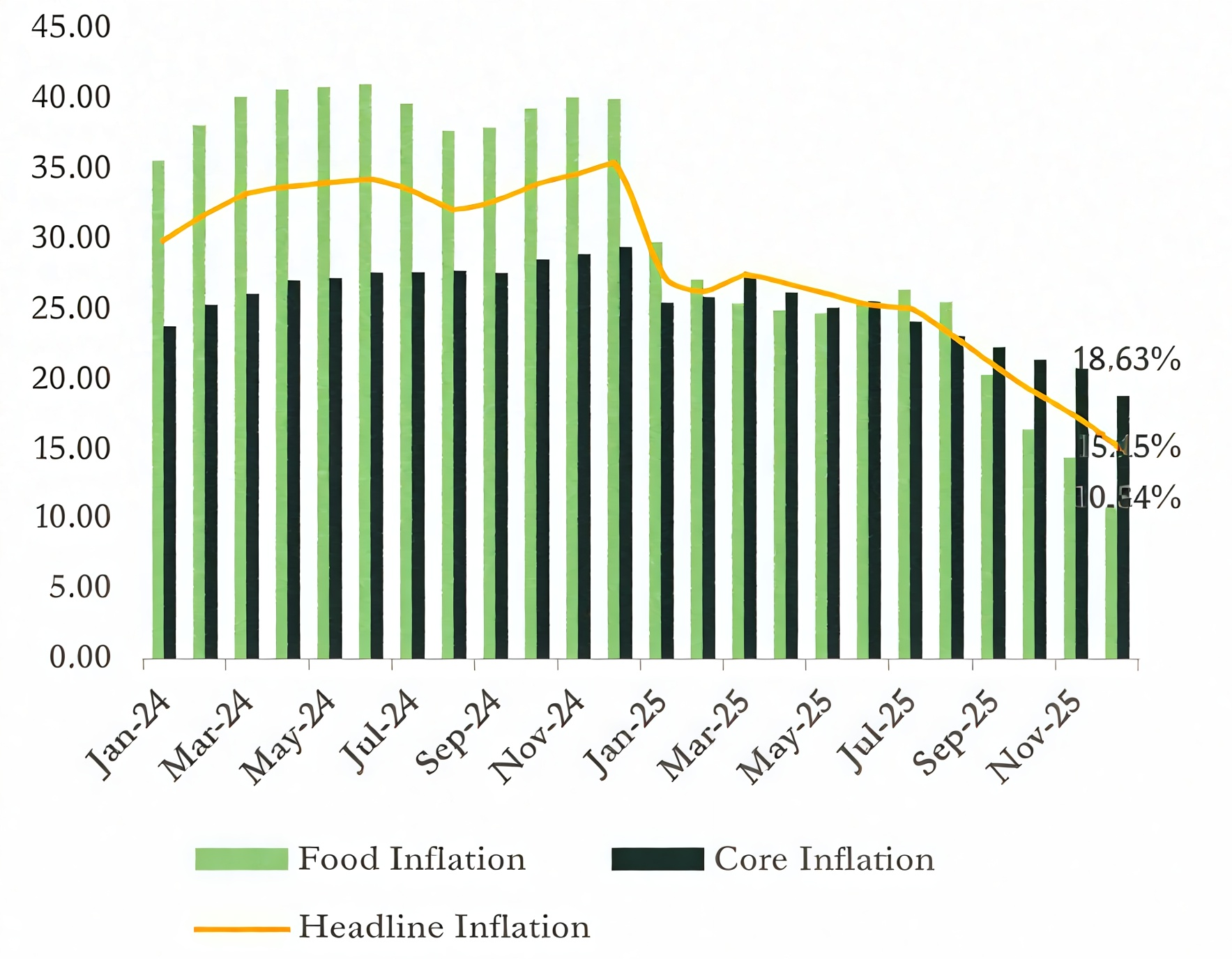

The decline follows the NBS’s adoption of a 12-month average CPI for 2024 as the reference period, replacing the previous single-month (December 2024) base. This change was implemented to eliminate an artificial inflation spike caused by base effects. Under the former methodology, headline inflation for December 2025 was projected to surge to about 31.2%, a distortion driven by the comparison base rather than a sharp acceleration in underlying price pressures. The revised approach, therefore, provides a more accurate representation of inflation dynamics, even as price levels remain elevated.

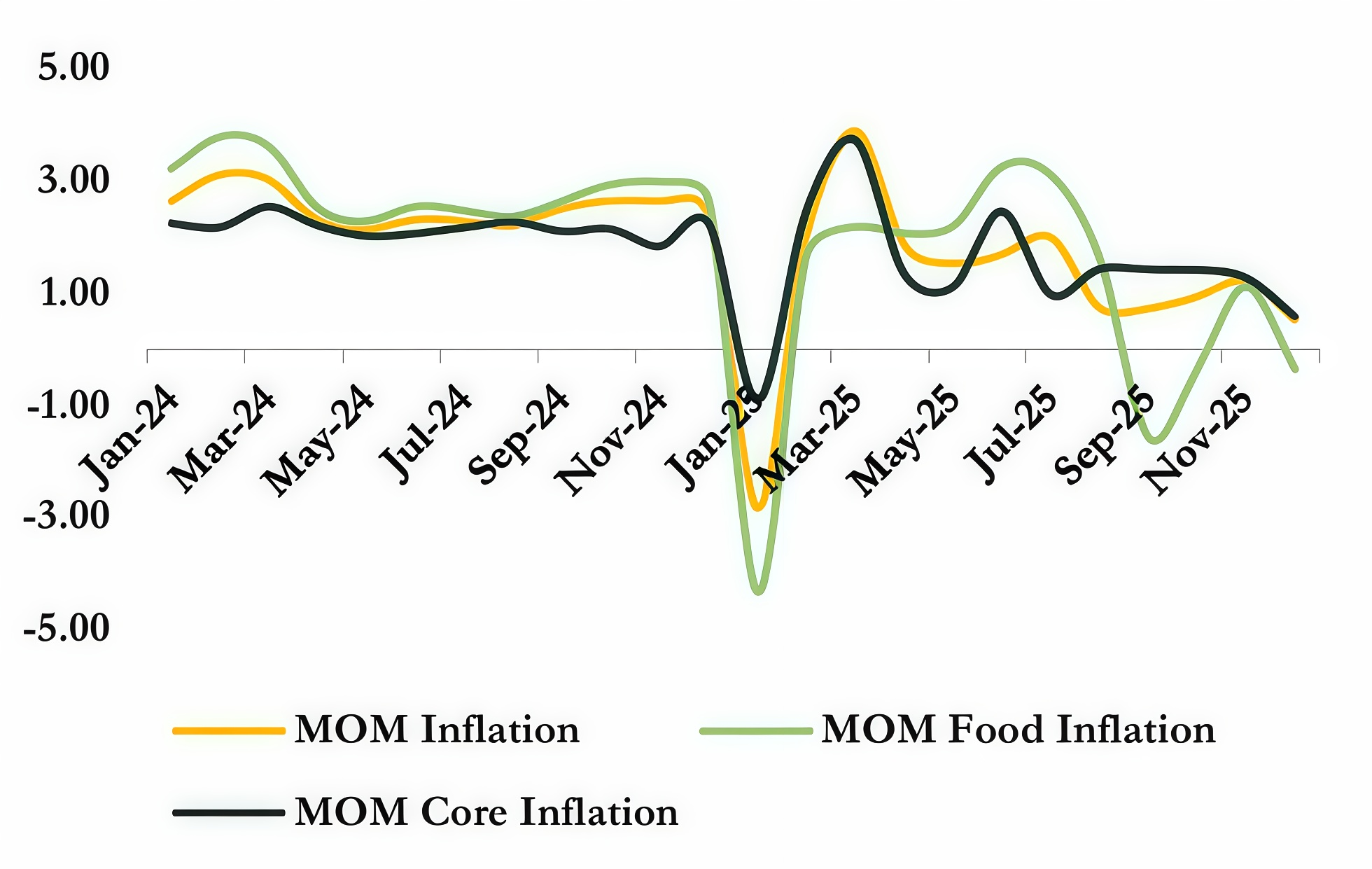

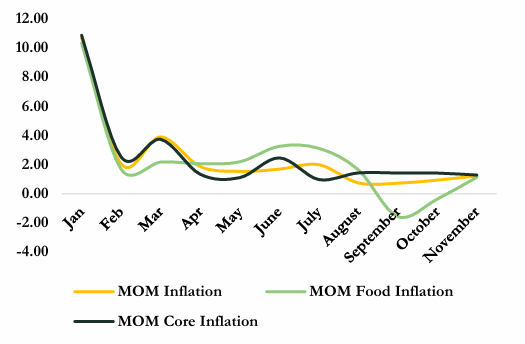

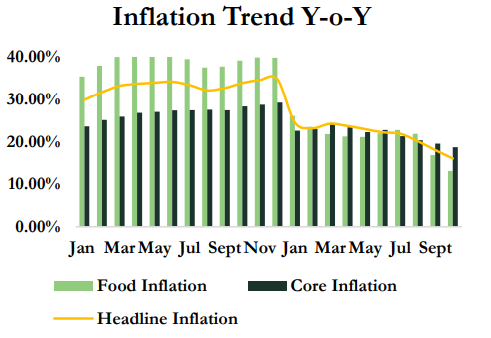

On a disaggregated basis, food inflation eased to 10.84% in December from 14.21% in November, while core inflation moderated to 18.63% from 20.59%, reflecting a broad based slowdown in price momentum following the methodological adjustment. On a month-on-month basis, headline inflation decelerated to 0.54%, down from 1.22% in the prior month. Food inflation turned negative at 0.36%, compared with 1.13% in November, suggesting easing short-term price pressures, while core inflation slowed to 0.58% from 1.28% previously.

OUTLOOK

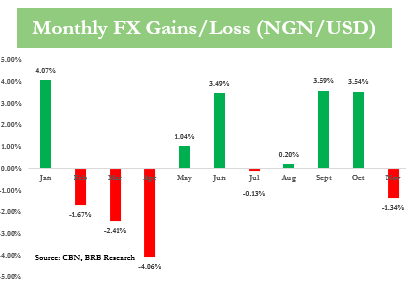

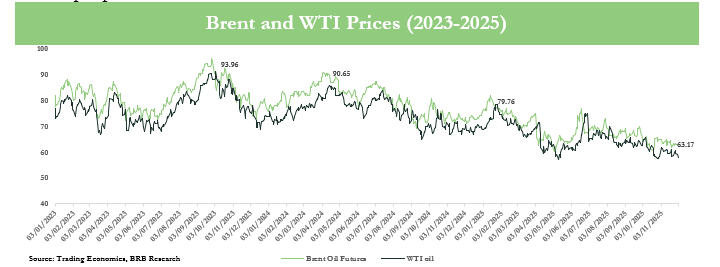

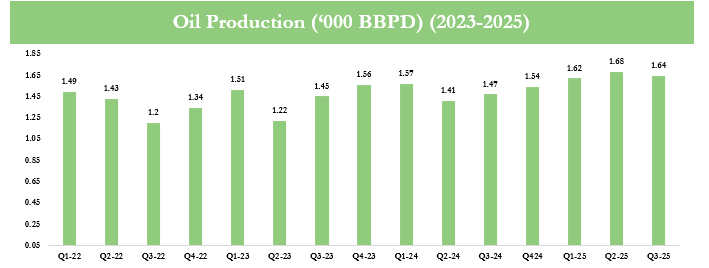

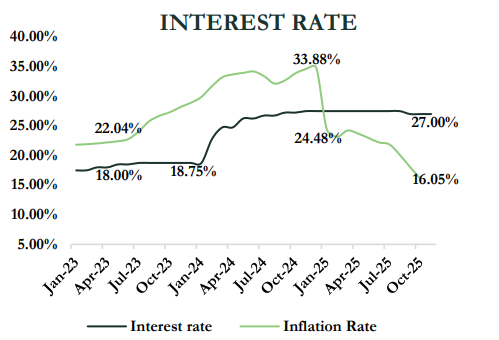

We expect headline inflation to maintain a downward trajectory in 2026, supported by a relatively stable exchange rate, which should help moderate imported inflation pressures. Additionally, a weaker global oil market, driven by a projected supply surplus, could further ease global energy prices. However, this presents a double-edged risk: while lower energy prices may reduce domestic fuel costs and ease transportation and logistics expenses, weaker oil prices could also dampen export earnings and exert pressure on the naira, potentially offsetting gains through higher import costs.

On balance, the anticipated disinflation trend may create room for the Monetary Policy Committee to begin a gradual pivot away from its current hawkish stance, should macroeconomic conditions remain supportive.

Y-o-Y Inflation Trend New CPI Series

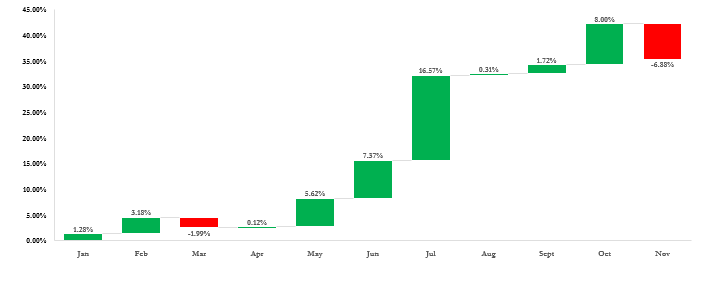

Y-o-Y Inflation Trend Old CPI Series

M-O-M Inflation Trend New CPI Series