MPC LOWERS INTEREST RATE AMID DISINFLATIONARY TREND

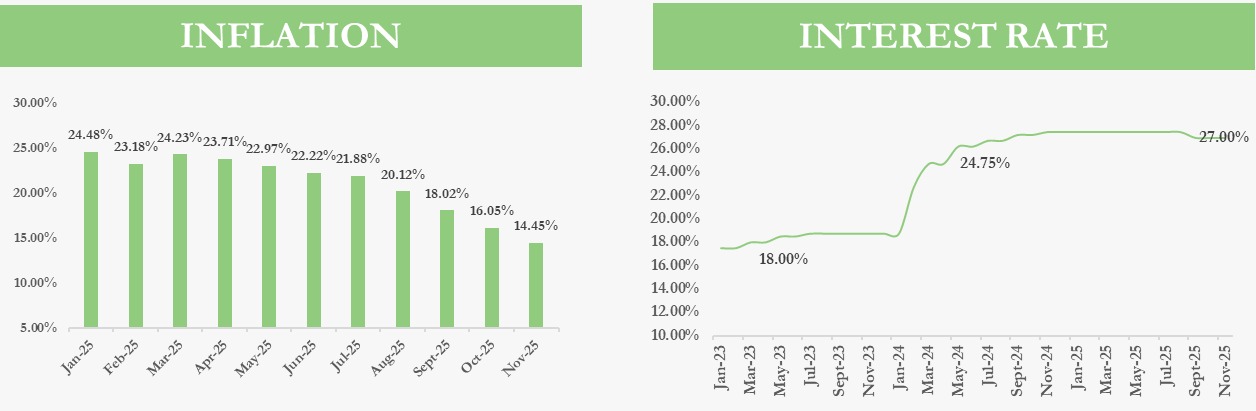

At the conclusion of the 302nd Monetary Policy Meeting (MPC) on 22nd and 23rd September 2025, the MPC voted to cut the Monetary Policy Rate (MPR) by 50 basis points from 27.50% to 27%, marking the first interest rate cut since September 2020.

Other key decisions include a reduction of the Cash Reserve Ratio (CRR) for Deposit Money Banks (DMB) by 500bps to 45.00%, while keeping the CRR for Merchant Banks at 16.00%. The MPC also retained the Liquidity Ratio at 30.00% and adjusted the Asymmetric Corridor to +250/-250bps around the MPR. Additionally, a 75.00% CRR on Non-TSA public sector deposits was introduced.

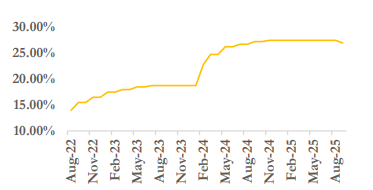

Interest Rate

This reflects a shift from the hawkish stance of the MPC since its monetary policy tightening cycle in 2023, with the intention to curb inflation. The MPR was raised from 18.50% in 2023 to 27.50% in November 2024, which was maintained in 2025.

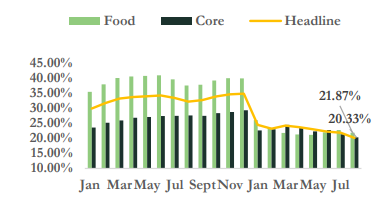

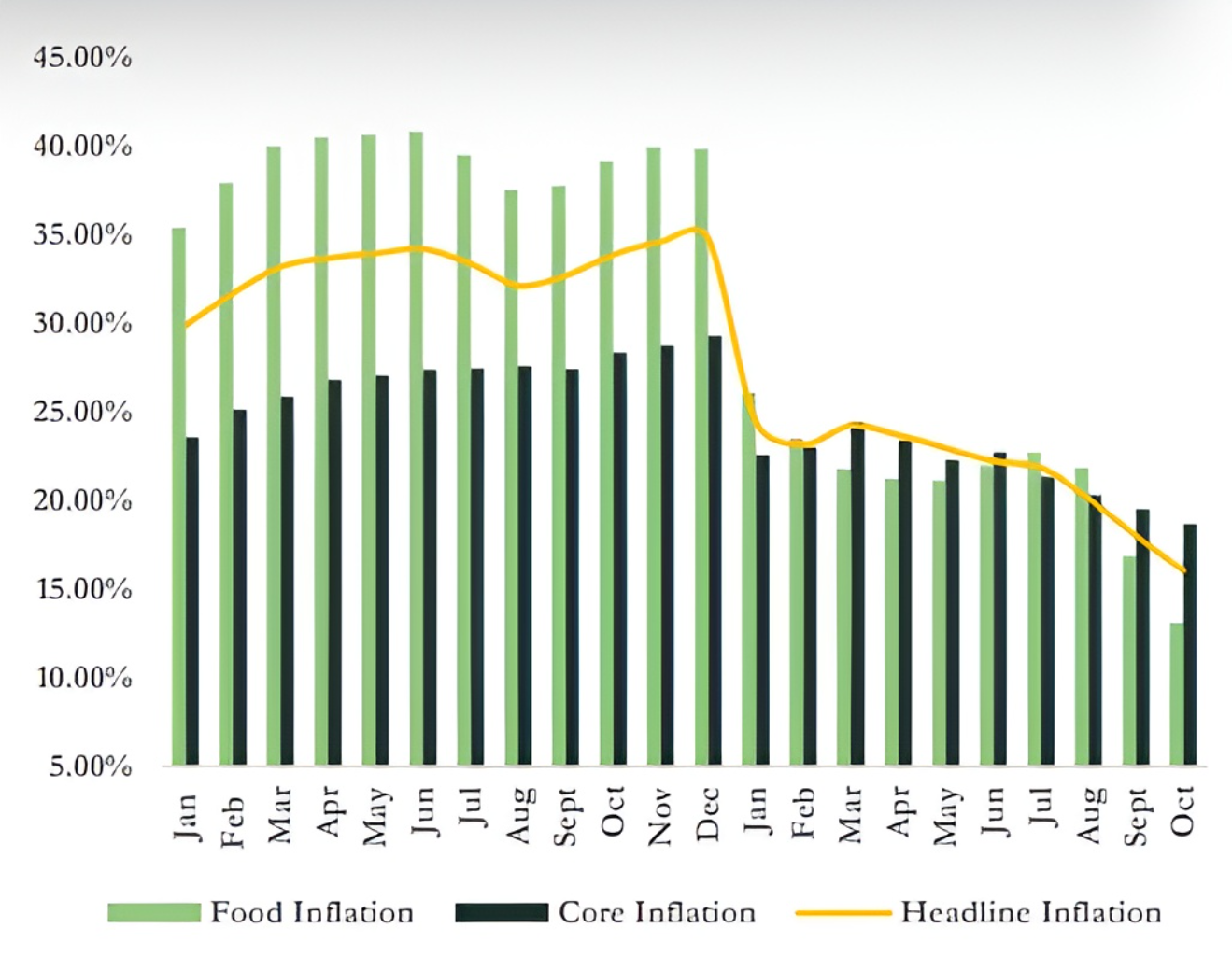

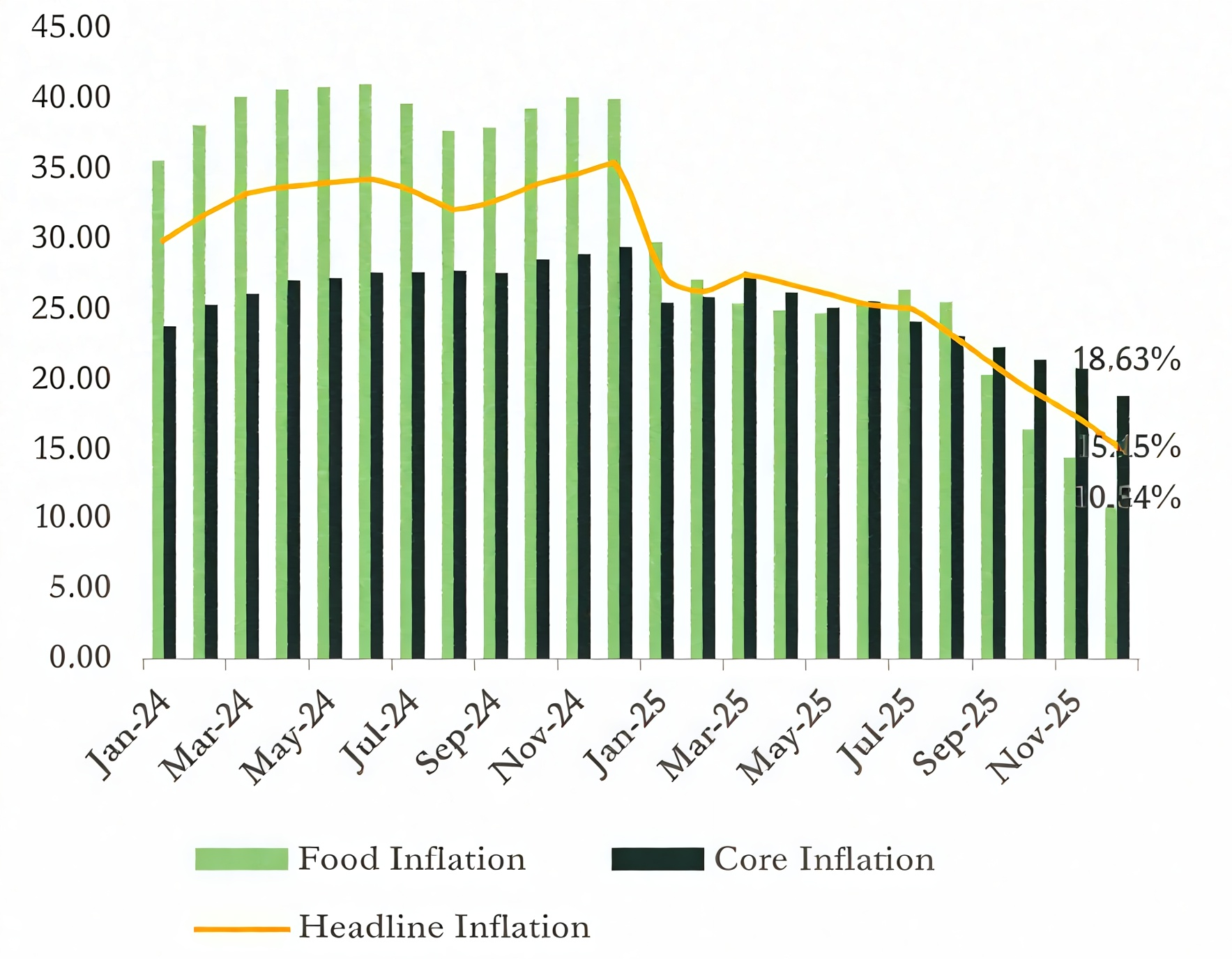

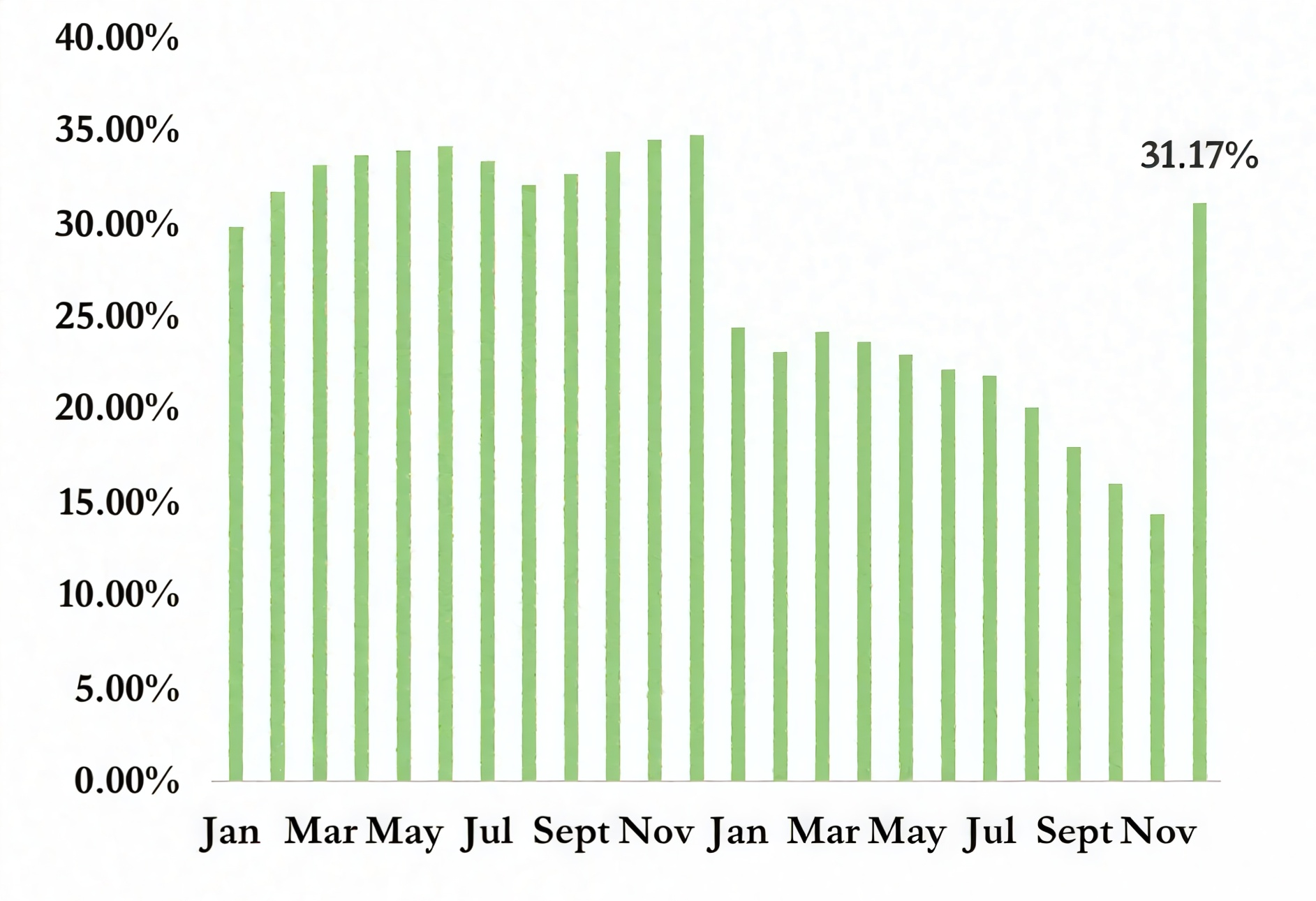

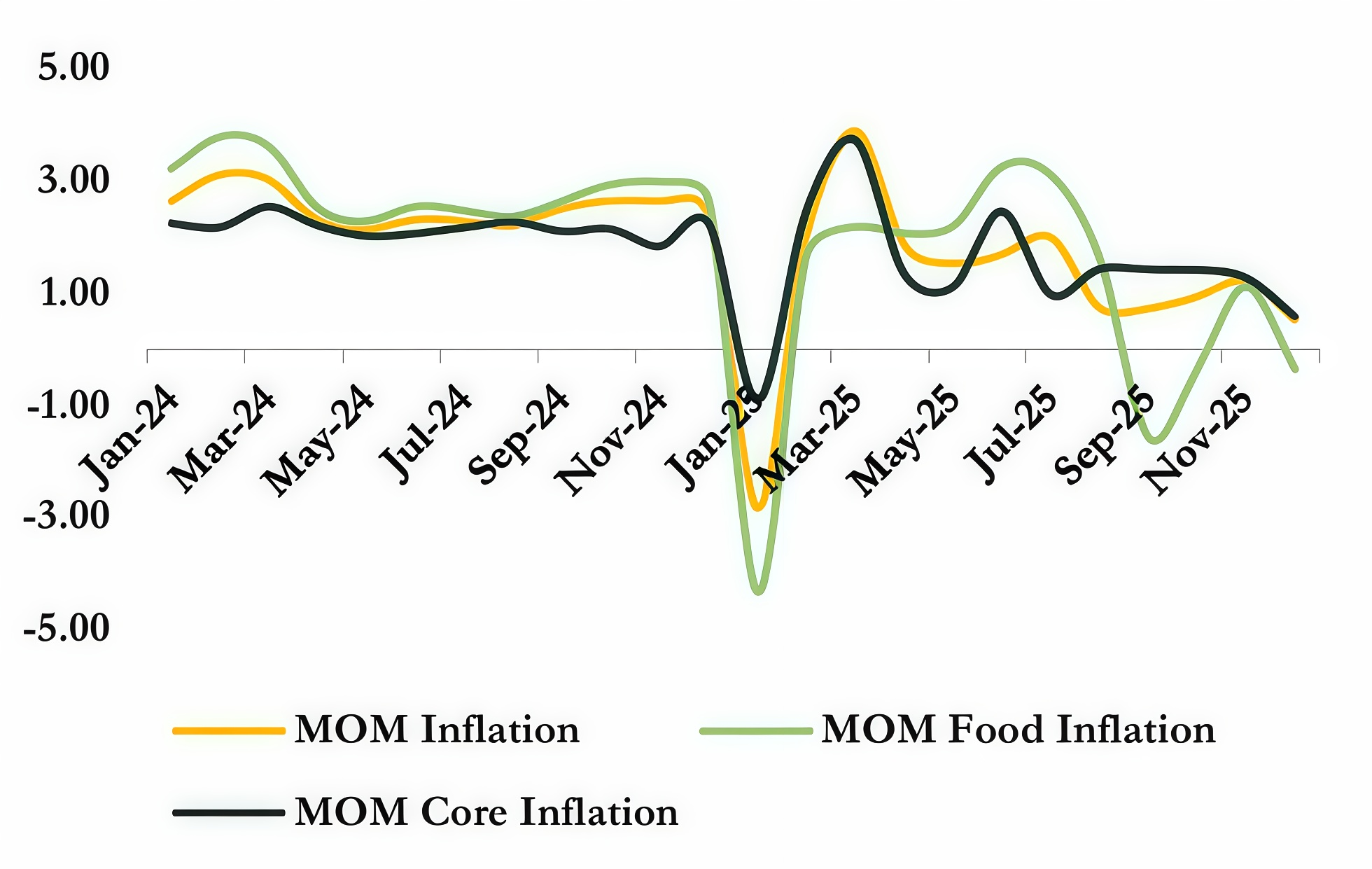

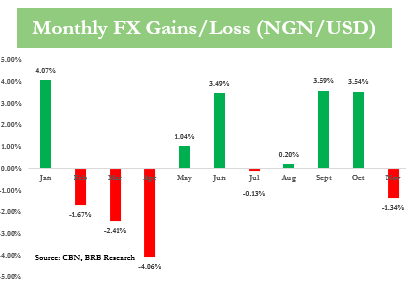

Nigeria’s headline inflation eased for the fifth consecutive month in August 2025 to 20.12%, largely driven by the rebasing effect, a reduction in food and core inflation components, and relative stability in the Naira.

Inflation Rate

The Global View

The CBN’s decision to lower the interest rate is in line with the global monetary authorities. The US Federal Reserve cut the federal funds rate by 25bps in September 2025, bringing it to 4.00%–4.25%. Conversely, the BoE and the ECB held rates steady at 4% and 2.15% respectively, following a monetary easing cycle since 2024.

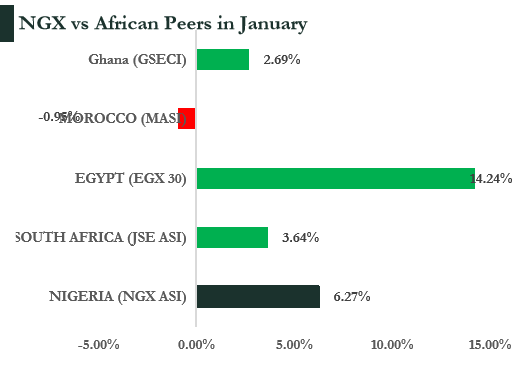

Shifting gaze to Africa, Ghana implemented a 350bps rate cut to 21.5% in September. Similarly, the Central Bank of Kenya and the Central Bank of Egypt lowered their interest rates by 25bps and 200bps to 9.5% and 22%, respectively, while the South African Reserve Bank left its interest rate unchanged at 7%.

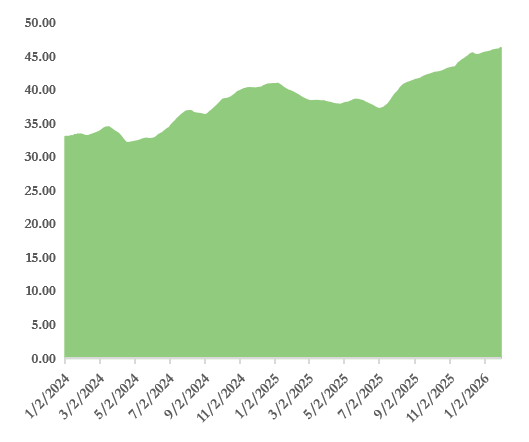

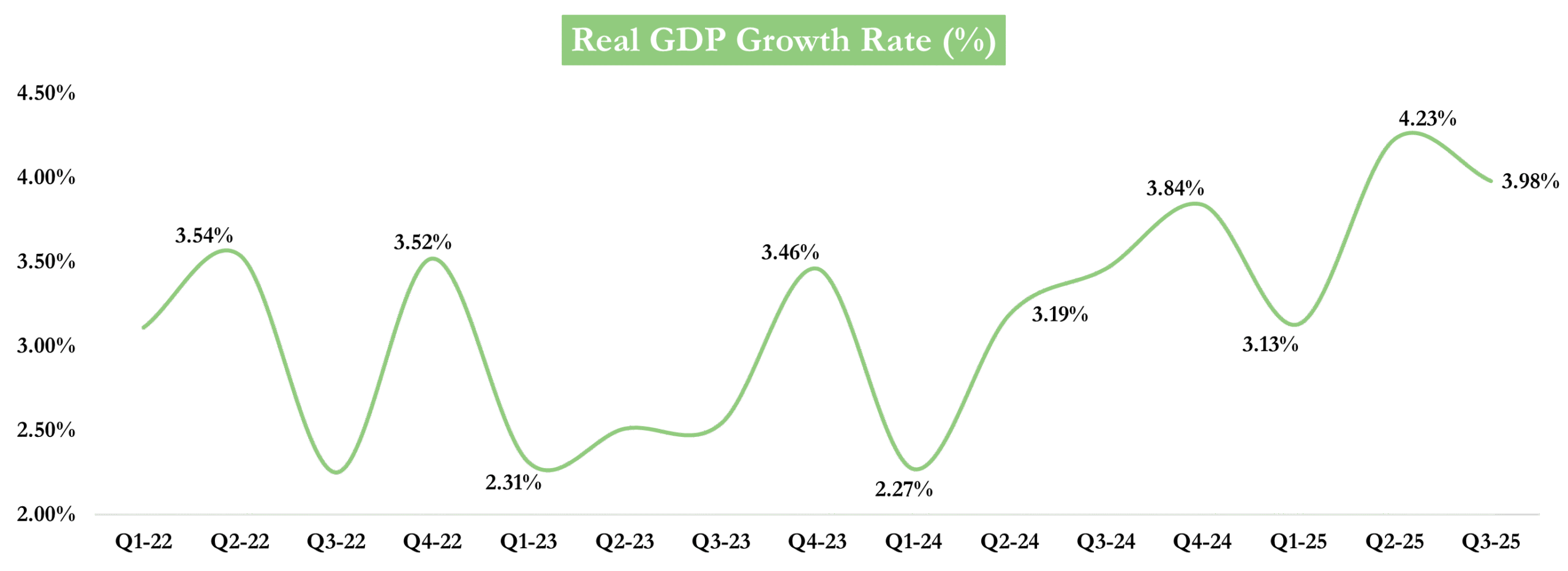

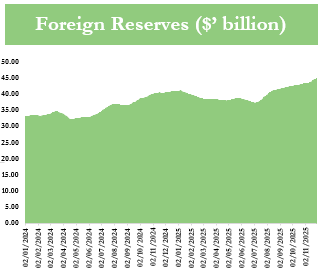

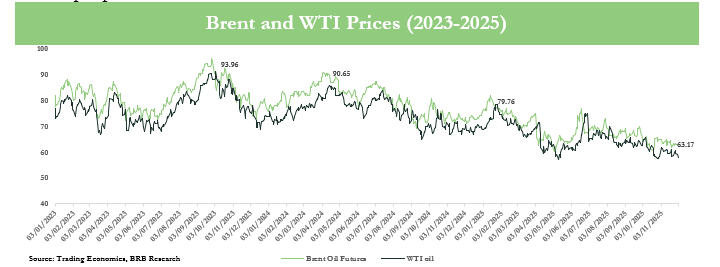

The CBN’s move to lower interest rates is backed by the continued disinflationary trend, resilient output growth, stable exchange rate, and robust external reserves. The MPC noted their satisfaction with macroeconomic stability as shown by improved inflation, stable Naira, stronger economic growth and robust FX reserves.

Impact Of Rate Cut

The CBN’s 50bps rate cut to 27%, reduction of banks’ CRR to 45% and the adjusted Asymmetric Corridor to +250/-250bps signal a shift toward stimulating growth after years of tight policy.

For banks, this provides improved liquidity, lower funding costs, and opportunities to expand credit to households and businesses (Corporate and SMEs). The move may also support asset quality as borrowers face reduced debt servicing costs, while easing could lift investor sentiment toward banking stocks and drive moderate margin improvements. The CBN’s imposition of a 75% CRR on non-TSA public deposits also drains liquidity, partly offsetting the benefits of the easing.

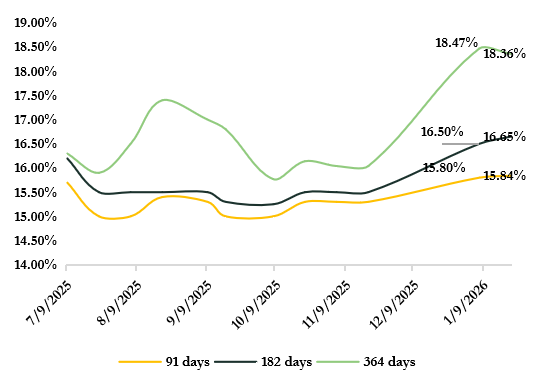

For the fixed income market, yields are likely to decline as liquidity improves and borrowing costs fall, lifting prices in the short term. This offers existing bondholders capital gains.

Overall, the policy creates a more enabling environment for lending, investment and growth in the economy. We expect a cautious easing stance from the CBN in the next meeting.

This colour looks weird

Can I share this report with you?

hi there , nice report