Source: FAFT website

Nigeria’s Exit from the FATF Grey List

Financial Action Task Force (FATF) is the global standard-setting body created in 1989 by the G7 to fight money laundering, terrorist financing and the financing of proliferation of weapons of mass destruction.

The Task Force researches how criminals and terrorists raise and move illicit funds, promotes international standards (the “FATF Recommendations”) and assesses countries’ implementation of those standards through peer reviews and follow-up.

With more than 200 countries and jurisdictions committed to apply its standards through its global network of regional bodies and partners such as the International Monetary Fund (IMF) and World Bank, the FATF acts as a watchdog: it monitors jurisdictions for strategic deficiencies in AML/CFT frameworks and can list them as “jurisdictions under increased monitoring” (“grey-list”) or “high‐risk jurisdictions” (“black-list”).

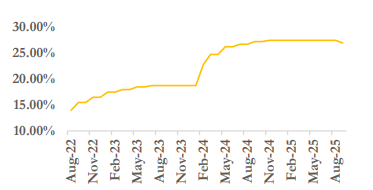

The Financial Action Task Force (FATF) formally announced Nigeria’s removal from its list of Jurisdictions under Increased Monitoring (commonly referred to as the “grey list”) during its Plenary session in Paris on October 24, 2025. This decision marks the successful and timely completion of a rigorous two-year reform process initiated after Nigeria’s inclusion on the list in February 2023. This decision means Nigeria is no longer subject to the enhanced scrutiny applied to countries with strategic deficiencies in anti-money-laundering (AML), counter-terrorist-financing (CFT) and proliferation-financing (CPF) regimes.

The FATF’s public statement specifies that Nigeria, along with Burkina Faso, Mozambique and South Africa, completed the required action plan and thus was removed from increased monitoring. Although Nigeria had faced previous FATF listings and monitoring processes in 2013.

Why it matters

Being on the grey list signalled that Nigeria had significant strategic deficiencies in its AML/CFT/CPF framework, weaknesses in regulation, supervision, inter-agency coordination, beneficial-ownership transparency and financial intelligence sharing.

Grey-listing carries practical implications such as increased due diligence by international banks, higher compliance costs, risk of correspondent-bank relationships being curtailed, and dampened investor confidence.

Being removed goes a long way to improve the country’s financial integrity and transaction credibility. This has a positive impact on the country’s ability to increase transactions around cross-border banking, trade finance, remittances and global capital flows.

Possible implications for the Nigerian economy

- Improved investor confidence: For international investors, viewing Nigeria as a lower-risk jurisdiction from an AML/CFT perspective improves terms of finance.

- Lower cost / improved access to global finance: Transaction costs (especially in banking, trade finance & remittances) could see a substantial reduction, while access to international capital markets could improve.

- Boost for fintech and trade sectors: Nigeria’s growing fintech ecosystem and trade flows may benefit from smoother cross-border transactions and improved interoperability with global financial networks.

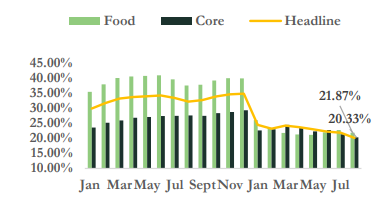

- Enhanced macro-policy credibility: The delisting offers a reputational boost for Nigeria’s reform programme (monetary, fiscal and institutional). It may assist in stabilising the currency, attracting diaspora remittances, and reducing capital flight concerns.

- Foreign Direct Investment (FDI) and Capital Access: The most significant long-term benefit of the delisting is the positive correlation between financial integrity and increase access to foreign capital. The impact extends particularly to institutional investors, such as global pension funds, sovereign wealth funds (SWFs), and large insurers. These entities often operate under strict mandates that explicitly restrict or prohibit investment in jurisdictions designated as high-risk by organizations like the FATF. The removal of the grey list status effectively unlocks access to vast pools of global long-term capital.

Key risks and caveats

Nigeria’s removal from the FATF grey list marks a significant milestone. Sustaining the achievement requires continuous reform and strong institutional enforcement of AML/CFT frameworks, as any policy relapse could quickly reverse the gains. The delisting only tackles one dimension of Nigeria’s risk profile; underlying macroeconomic challenges such as high inflation, foreign exchange instability, fiscal deficits, the large informal sector, and persistent security concerns continue to weigh on investor confidence and growth potential. Moreover, the measurable benefits of the FATF delisting will take some time to discern, as improved access to global finance and restored correspondent banking relationships depend on consistent policy credibility and gradual rebuilding of international trust.

Based on the timelines of similar countries, Nigeria’s next full FATF Mutual Evaluation is anticipated around 2028. The failure to embed current improvements and secure long-term sustainability could lead to an unfavourable assessment during that evaluation, thereby heightening the risk of re-listing and undermining recent progress.

Furthermore, a critical observation from the November 2024 follow-up report (FUR) highlights the existence of several technical gaps despite the overall success in demonstrating effectiveness. Specifically, several recommendations concerning crucial risk areas were still rated as Partially Compliant (PC), including

R. 12 Politically Exposed Persons (PEPs): Vulnerability exists in the framework for adequate monitoring and mitigation of risks associated with domestic and foreign PEPs.

R. 15 (New Technologies): The regulation of emerging financial products, particularly Virtual Asset Service Providers (VASPs) and related new technologies, remains underdeveloped.

R. 22 Designated Non-Financial Businesses and Professions (DNFBPs) Customer Due Diligence (CDD): Continued weaknesses are present in the full implementation and enforcement of Customer Due Diligence (CDD) requirements across the full spectrum of Designated Non-Financial Businesses and Professions.

Recommendations for stakeholders

- Government / Regulators: The Central Bank of Nigeria (CBN), Economic and Financial Crimes Commission (EFCC), Nigerian Financial Intelligence Unit (NFIU) and Ministry of Finance should continue to strengthen beneficial-ownership registries, financial intelligence sharing, supervision of high-risk sectors (fintech, remittances, cross-border trade), and embed the reforms into institutional systems to ensure sustainability.

- Banks & Fintech firms should use the improved standing to renegotiate correspondent banking access, expand international partnerships, enhance cross-border remittance/payment services, and scale trade-finance solutions, while maintaining strong AML/CFT compliance.

- Investors should reassess Nigeria’s country-risk premium in light of the delisting. However, it is expected that investors would continue to evaluate macro-economic and governance risks.

Conclusion

Nigeria’s exit from the FATF grey list is a significant institutional and reputational milestone, signalling that the country has addressed key deficiencies in its AML/CFT framework. While this alone does not equate to total eradication, it is a critical step towards opening up a clearer path for improved access to global finance, stronger cross-border trade, fintech-powered remittances and enhanced investor confidence. The ultimate payoff will depend on sustained reform, improved macroeconomic policies, and regulatory oversight working together to rebuild the trust of the global financial system.

References

- FATF, Outcomes FATF Plenary, 22-24 October 2025. FATF

- https://www.fatf-gafi.org/en/publications/Mutualevaluations/fur-nigeria-2024.html

- FATF, Jurisdictions under Increased Monitoring – 24 October 2025. FATF

- “Nigeria’s removal from FATF grey list marks boost for financial credibility – CBN”, Premium Times, 26 October 2025. Premium Times Nigeria

- “What Nigeria’s delisting from the FATF Grey List means for the economy”, Daily Trust, 27 October 2025. Daily Trust

- “Nigeria’s exit from the FATF grey list: A major boost to President Tinubu’s economic and monetary reforms”, BusinessDay, 26 October 2025. Businessday NG

- “South Africa, Nigeria exit global financial crime watch list”, Reuters, 24 October 2025. Reuters

- “South Africa and Nigeria removed from money laundering ‘grey list’”, Financial Times, 24 October 2025. Financial Times

Insightful post