- Insights

BRB Monthly Market Report January 2026

MACROS

Nigeria’s macroeconomic landscape in January 2026 reflected a clear shift toward stabilization, supported by moderating inflation, improving foreign exchange dynamics, and growing international confidence in the reform trajectory of the economy. These developments provided a supportive backdrop for domestic financial markets and reinforced expectations of a more balanced macroeconomic environment in 2026.

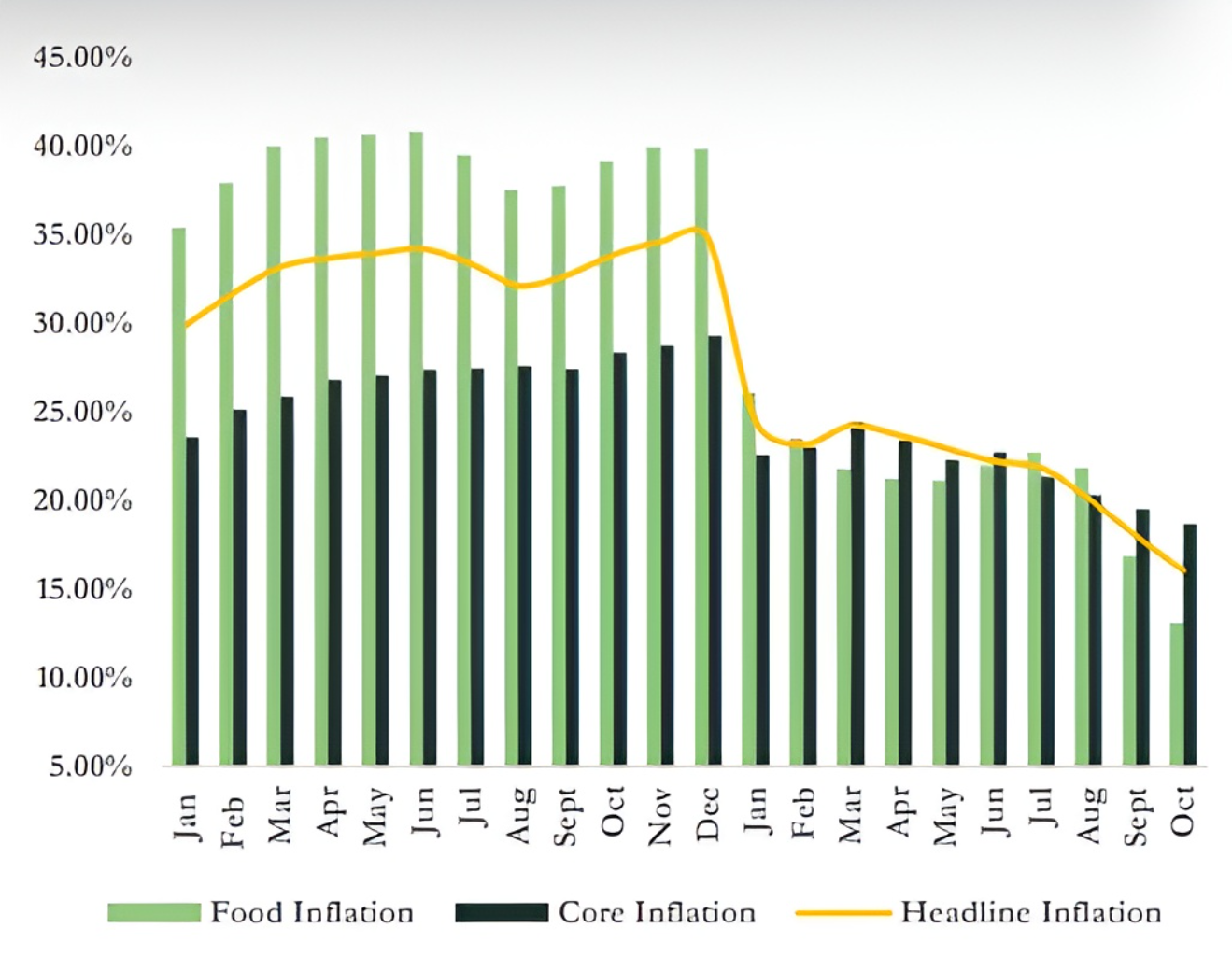

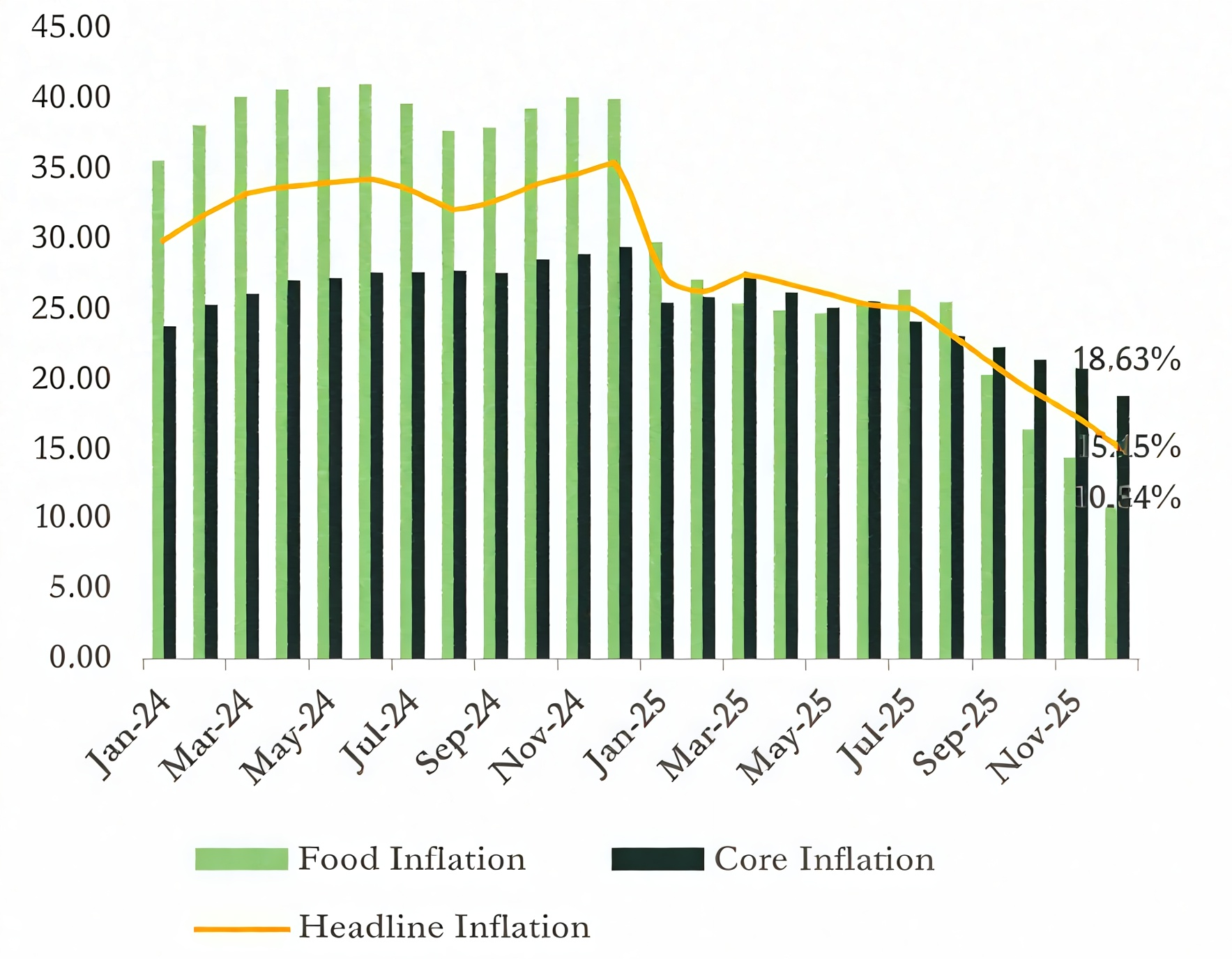

Inflation dynamics improved during the period, with headline inflation moderating to 15.15% in December 2025 from 17.33% in November, according to the National Bureau of Statistics. This decline was largely

driven by the adoption of a revised Consumer Price Index methodology, which rebased the index to 2024 and transitioned to a 12-month average reference period. Under the previous 2009 methodology, inflation would have remained significantly higher, underscoring the technical component of the observed disinflation.

Nonetheless, underlying price pressures also eased, with food inflations lowing for the fifth consecutive month to 10.84%, supported by seasonal harvest effects and a firmer naira, while core inflation declined to 18.63% from 20.59%, reflecting reduced pass-through from exchange rate pressures.

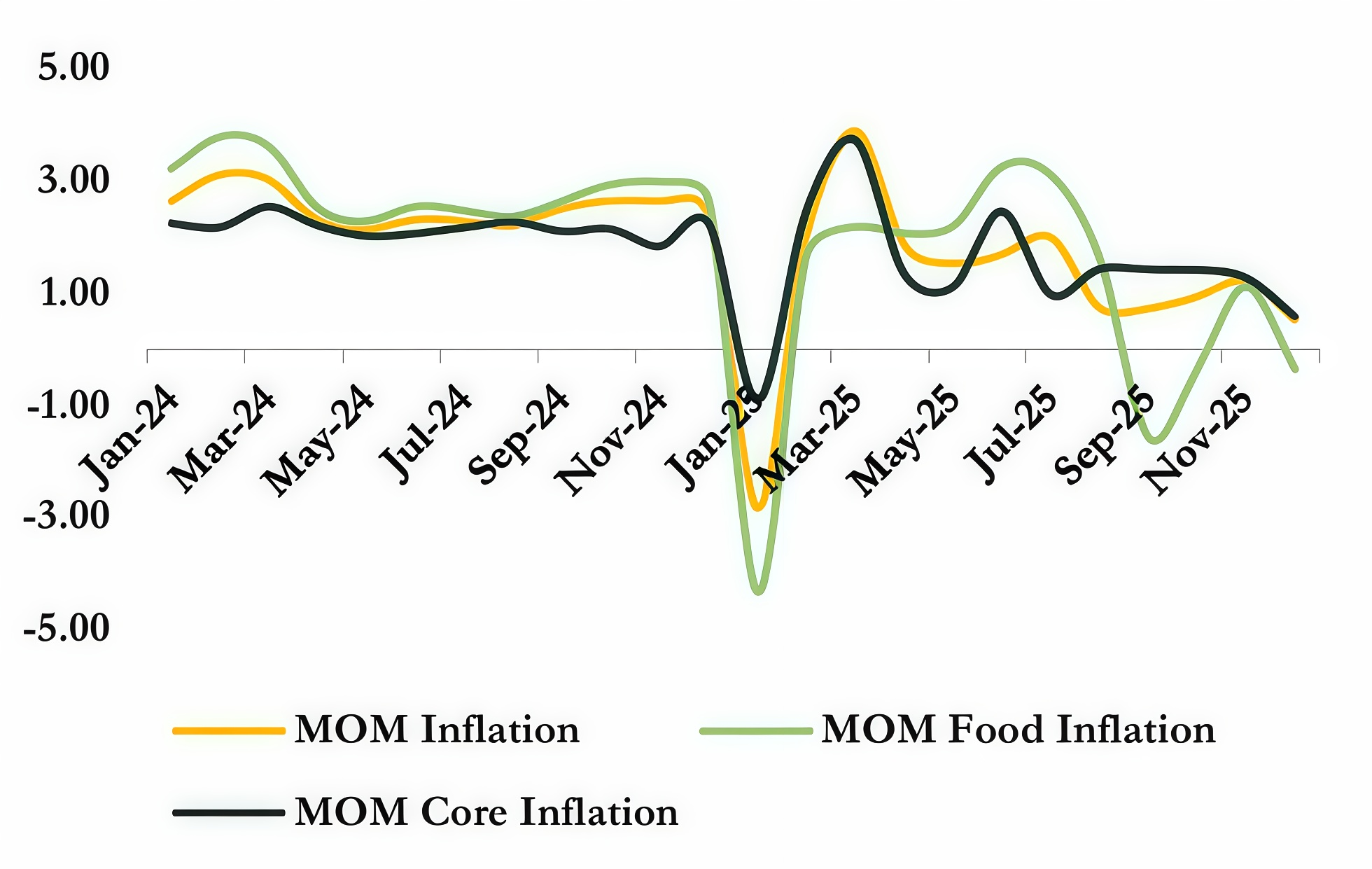

Inflation Trajectory

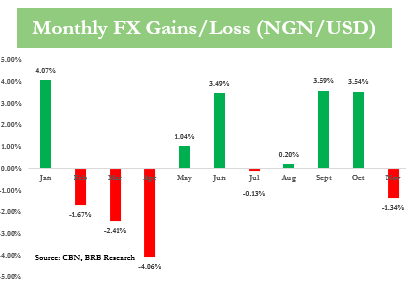

In the foreign exchange market, stability at the Nigerian Foreign Exchange Market (NFEM) window improved noticeably in January. The naira strengthened toward the end of the month, closing within

the ₦1,386/$ to ₦1,401/$ range, as foreign portfolio inflows increased and liquidity conditions improved. Attractive domestic yields, coupled with enhanced confidence in policy direction, encouraged offshore participation in the fixed income market, easing demand pressures on the currency. This was further supported by improved supply from exporters and market participants, reinforcing near-term exchange rate resilience

Economic activity indicators also pointed to strengthening momentum. The Central Bank of Nigeria’s composite Purchasing Managers’ Index rose to 57.6 points in December 2025, marking the fastest pace of expansion in nearly five years and extending the expansionary trend to thirteen consecutive months.

Growth was broad-based across sectors, with agriculture leading, followed by strong recoveries in industrial output and services activity. The PMI data suggest improving business confidence and strengthening domestic demand entering 2026.Nigeria’s international financial standing improved further during the month, following its formal removal from the European Union’s list of high-risk third countries for money laundering and terrorism financing, effective January 29, 2026. This development followed Nigeria’s earlier exit from the Financial Action Task Force grey list in October 2025 and represents a significant milestone in restoring global credibility. The delisting is expected to reduce transaction friction for cross-border flows, improve correspondent banking relationships, and broaden the base of international investors engaging with Nigerian assets.

The improving macro narrative was reinforced by the International Monetary Fund’s upward revision of Nigeria’s 2026 growth forecast to 4.4% in its January World Economic Outlook update. The revision reflects confidence in ongoing structural reforms, improved macroeconomic coordination, and stronger productivity across agriculture, manufacturing, and services. Nigeria is now positioned as a notable contributor to global growth in 2026, with an outlook that compares favorably to several peer economies.

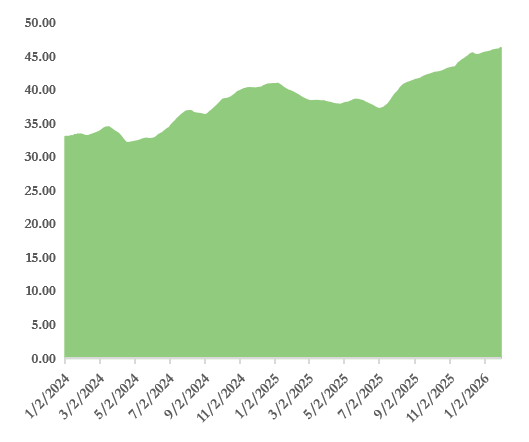

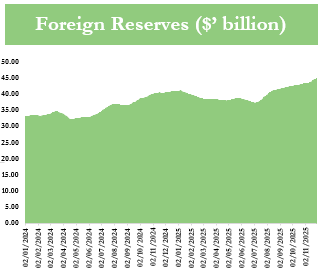

External buffers continued to strengthen, providing additional support to macro stability. Gross external reserves rose to approximately $46.1 billion by the end of January, up from $45.0 billion at the close of 2025. The improvement was driven by higher oil receipts, steady diaspora remittances, and sustained portfolio inflows. Forward projections suggest reserves could exceed $51billion by year-end, reinforcing the Central Bank’s capacity to manage currency volatility and absorb external shocks.

MACROS

Looking ahead to February 2026, inflation is expected to continue its gradual moderation, supported by base effects from the revised CPI methodology, stable exchange rate conditions, and easing food supply pressures. Headline inflation is likely to trend marginally lower or remain broadly stable in the near term. However, risks to this outlook include potential energy price shocks, changes to administered prices, or renewed exchange rate volatility, particularly if global commodity prices spike or domestic supply disruptions emerge.

The exchange rate is expected to remain relatively stable in February, with the naira likely to trade around the ₦1,400/$ level, supported by sustained portfolio inflows, improved reserve buffers, and ongoing price discovery at the NFEM window. Nonetheless, downside risks persist, including the possibility of capital flow reversals if global financial conditions tighten, heightened geopolitical tensions affecting oil markets, or delays in oil production recovery. Maintaining confidence in policy consistency and reform implementation will remain critical to preserving near-term currency stability.

The macroeconomic environment entering February 2026 reflects an improving balance, with stabilization increasingly anchored by structural reforms rather than temporary market interventions. While vulnerabilities remain, the convergence of moderating inflation, strengthening external buffers, and rising international confidence provides a more resilient foundation for economic and financial market performance in the months ahead.

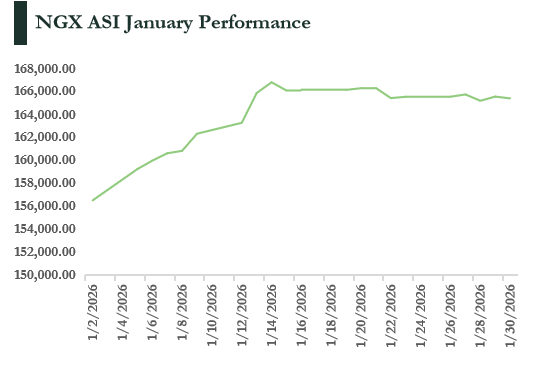

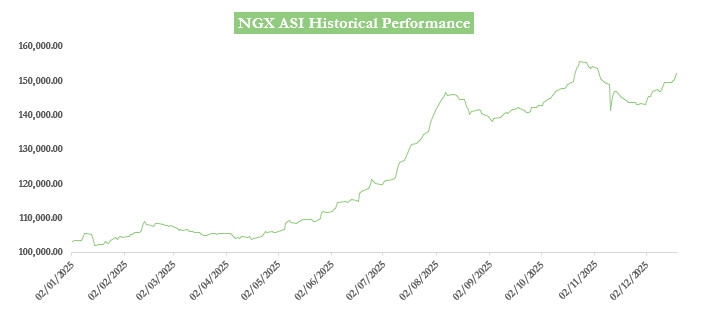

The Nigerian equities market began 2026 on a relatively positive footing, extending the bullish momentum seen in late 2025. This performance was underpinned by improving macroeconomic signals that suggested early signs of economic stabilization, alongside renewed investor confidence. As a result, total market capitalization on the Nigerian Exchange (NGX) increased by ₦6.8 trillion during January, closing at ₦106.15 trillion compared to ₦99.38 trillion at the end of December 2025

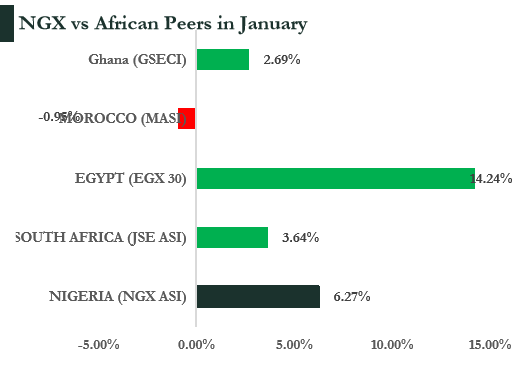

This 6.8% month-on-month expansion was largely driven by price appreciation in major blue-chip stocks, complemented by fresh capital inflows through primary market activities. Reflecting these gains, the NGX All-Share Index (ASI) delivered a strong start to the year, recording both month-to-date and year-to-date returns of 6.27% to close January at 165,370.40 points.

This performance was not an isolated development but broadly aligned with trends across global and Pan-African equity markets. Notably, the NGX outperformed several African peers, including the BRVM and the Moroccan exchange, which recorded more muted starts to the year.

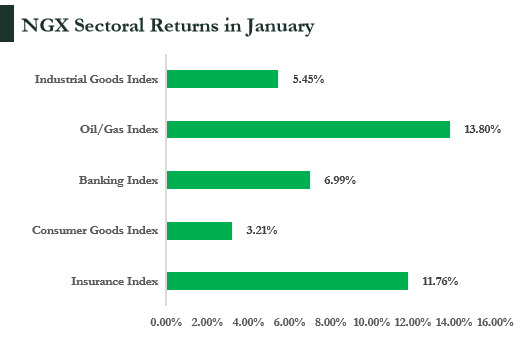

Sectoral performance on the NGX in January 2026 largely reflected the broader market’s bullish tone, with most indices closing the month in positive territory as investors selectively rotated into high-conviction sectors. The Oil and Gas index emerged as the top performer, advancing by 13.80%, driven by price gains in key integrated energy stocks such as SEPLAT (+15.34%) and ARADEL (+16.45%). Institutional confidence was further reinforced by improved governance sentiment following strategic board appointments, including the induction of Mr. Tony Elumelu to Seplat Energy’s board.

The Insurance index followed closely, rising by 11.76% on the back of ongoing recapitalization efforts and broad-based price appreciation across the sector. Notable gainers included NEM Insurance (+19.40%), AIICO (+10.82%), Veritas Kapital (+43.27%), and Mutual Benefits Assurance (+34.84%), reflecting improving sentiment toward balance sheet strengthening and earnings recovery prospects.

The Banking index posted a solid 6.99% gain, supported by renewed interest in fundamentally strong lenders such as GTCO (+9.15%), Zenith Bank (+15.61%), Wema Bank (+14.71%), and Access Holdings (+7.62%), as investors positioned for resilient earnings and attractive dividend yields. Similarly, the Industrial Goods index advanced by 5.45%, driven largely by gains in Dangote Cement (+4.27%) and Lafarge Africa (+16.73%), amid sustained demand expectations within the construction value chain.

Meanwhile, the Consumer Goods index added 3.21%, extending its steady appreciation after emerging as the bestperforming sector in 2025. Gains in Nestlé Nigeria (+10.00%), Cadbury Nigeria (+11.85%), Unilever Nigeria (+8.33%), and Dangote Sugar (+8.33%) underscored continued investor preference for companies with relatively strong pricing power and improving margin outlooks.

Despite the NGX All-Share Index delivering a 6.27% return in January, stock-level performance was highly dispersed, creating meaningful alpha opportunities for active managers. Several mid- and small-cap stocks recorded outsized gains, driven by sector repositioning, low-float dynamics, and renewed speculative interest. Deap Capital Management & Trust Plc (+394.21%) and SCOA Nigeria Plc (+345.07%) led the advancers, while strong performances were also recorded in NCR Nigeria Plc (+173.73%), Zichis Agro Allied Industries Plc (+131%), particularly notable as a recent IPO, and Multiverse Mining, supported by improving sentiment in the mining and basic materials sector.

On the downside, a small number of stocks underperformed, largely due to profit-taking following extended rallies rather than fundamental weakness. Ikeja Hotel Plc (-23.03%) declined as investors locked in gains in the hospitality sector, while Juli Plc (- 9.93%) and Austin Laz (-8.24%) faced selling pressure amid rotation within the retail and services space. Conoil Plc (-9.72%) also recorded a modest pullback, standing out as a rare decliner within the Oil and Gas sector, with price weakness largely reflecting technical corrections.

Market direction in February is expected to be driven largely by the release of audited 2025 financial results and dividend announcements. Nigeria’s dividend season typically supports equity prices, as investors rotate toward fundamentally strong, high-yield stocks. The banking sector should remain the center of activity amid ongoing recapitalization, while potential large-scale listings, such as the anticipated Dangote Refinery IPO, present upside catalysts for market liquidity and capitalization. Continued traction on the Growth Board also points to a growing pipeline of SME listings, particularly in agriculture and technology. Macroeconomic risks remain centered on inflation trends and monetary policy. However, strong market capitalization and resilient earnings among large-cap stocks suggest the NGX is well positioned to sustain positive momentum into February 2026.

FIXED INCOME

Domestic Money Market and System Liquidity

The Nigerian fixed income market in January 2026 was characterized by ample system liquidity, shifting yield dynamics, and improved investor confidence following favorable macroeconomic developments.

Market sentiment was largely shaped by the moderation in headline inflation and the Central Bank of Nigeria’s decision to maintain a tight but stable monetary policy stance. These factors drove strong participation at primary market auctions and contributed to yield compression toward the latter part of the month.

A key catalyst was the National Bureau of Statistics’ release of December 2025 inflation data, which showed headline inflation easing to 15.15% from 17.33% in November. The decline was primarily attributed to revisions in the Consumer Price Index methodology, including rebasing to 2024 and the adoption of a 12- month average reference period. This perceived disinflationary trend supported fixed income demand and reinforced expectations of yield stabilization.

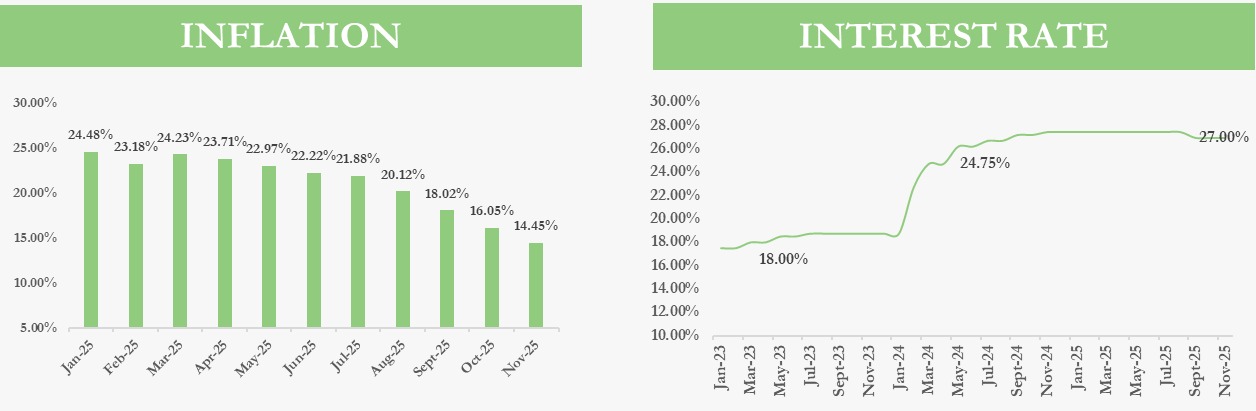

Against this backdrop, the CBN retained the Monetary Policy Rate at 27.0% at its January meeting, signaling policy continuity. The moderation in inflation expectations provided a tailwind for fixed income instruments, particularly at the long end of the Treasury curve, as investors increasingly priced in lower real yield pressures.

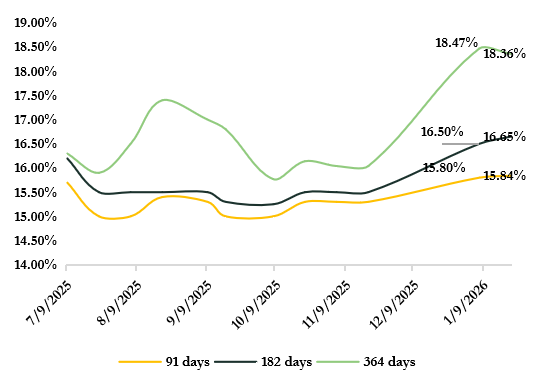

In the Treasury bills primary market, investor demand remained robust throughout the month. At the January 7 auction, the CBN offered ₦1.15 trillion across the 91-day, 182-day, and 364-day tenors, attracting total subscriptions of ₦1.54 trillion and a bid-cover ratio of 1.35x. Although stop rates increased across all tenors, clearing at 15.80%, 16.50%, and 18.47%, respectively, strong participation

underscored sustained appetite for short-dated government securities.

Demand intensified at the January 21 auction, where ₦1.15 trillion was again offered. Total subscriptions surged to ₦3.44 trillion, translating to a bid-cover ratio of 3.24x, with particularly strong interest in longer-dated bills. While stop rates for the 91-day and 182-day instruments edged higher to 15.84% and 16.65%, the 364-day bill cleared lower at 18.36%, reflecting growing investor preference for duration. The

relatively low allotment rate suggests that unmet bids are likely to flow into the secondary market.

Eurobonds and Global Confidence

Nigerian Eurobonds traded with mixed-to-moderately positive sentiment in January 2026, shaped by a combination of global macroeconomic developments, geopolitical risks, and improving domestic fundamentals. Early in the month, investor sentiment was cautious amid heightened global risk aversion, driven by volatility in energy markets, geopolitical tensions in the Middle East, and supply disruptions caused by severe winter storms in the United States. These factors contributed to short-term oil price volatility, with Brent crude briefly trading above USD70/bbl as markets repriced supply risks.

Additional uncertainty stemmed from concerns around U.S. foreign policy actions, including interventions in Venezuela, which raised the prospect of disruptions to global oil supply. Given Nigeria’s continued reliance on oil revenues, sustained volatility in crude prices remained a key macro risk, influencing foreign investor positioning in Nigerian sovereign debt during the early part of the month.

Mid-month sentiment improved as U.S. Treasury yields eased and oil prices stabilized following their initial spike. Softer U.S. jobless claims and the U.S. Federal Reserve’s decision to hold policy rates reinforced expectations of a prolonged pause through most of H1 2026, following cumulative rate cuts in late 2025. This shift supported renewed demand for emerging market debt, leading to modest yield compression across Nigerian Eurobonds.

By the latter half of January, buying interest strengthened, driving the average benchmark Nigerian Eurobond yield down to approximately 7.12%. However, profit-taking ahead of key global macro events and renewed upward pressure on U.S. Treasury yields toward month-end resulted in mild volatility, with the benchmark yield ticking higher to around 7.23% in the final trading sessions. Nigerian Eurobonds closed the month slightly weaker on a month-on-month basis, reflecting cautious investor positioning amid persistent global uncertainty.

FIXED INCOME

A major positive development during the month was Nigeria’s formal removal from the European Union’s list of high-risk third countries for money laundering and terrorism financing, which took effect on January 29, 2026. This followed Nigeria’s earlier exit from the Financial Action Task Force (FATF) grey list in October 2025, representing a significant improvement in the country’s international financial standing. The delisting is expected to reduce compliance costs for cross-border transactions, enhance correspondent banking relationships, and foster broader participation by foreign portfolio investors in Nigeria’s fixed income and Eurobond markets in the medium term.

OUTLOOK

The Nigerian fixed-income market is set for a gradual recalibration. With the CBN maintaining tight monetary conditions and ample liquidity, short-term NTB yields are expected to ease, providing investors with opportunities to secure attractive returns ahead of potential rate adjustments. Demand for longer-dated government bonds remains robust, supported by stable coupon payments and potential capital appreciation in a moderating yield environment.

Fiscal discipline and strategic debt management will be key. A shift toward lower-cost, long-dated instruments, including diaspora bonds, Sukuk, or green bonds, combined with efforts to diversify non-oil revenues, could enhance debt sustainability and bolster investor confidence. This outlook depends on continued macro stability, easing inflationary pressures, and contained external debt risks.

On the external front, while Eurobond issuances have drawn strong demand, global rate dynamics and geopolitical risks could pressure yields, underscoring the need for vigilance. Overall, highyield, long-term government debt and Tbills is likely to remain a preferred allocation in the near to medium term, contingent on stable macro fundamentals and consistent policy execution.

- Report

December 2025 Inflation Report

Inflation eased to 15.15% in December 2025 following an adjustment by the NBS.

Nigeria’s headline inflation moderated to 15.15% year-on year in December 2025, down from 17.33% in November, reflecting a methodological adjustment by the National Bureau of Statistics (NBS).

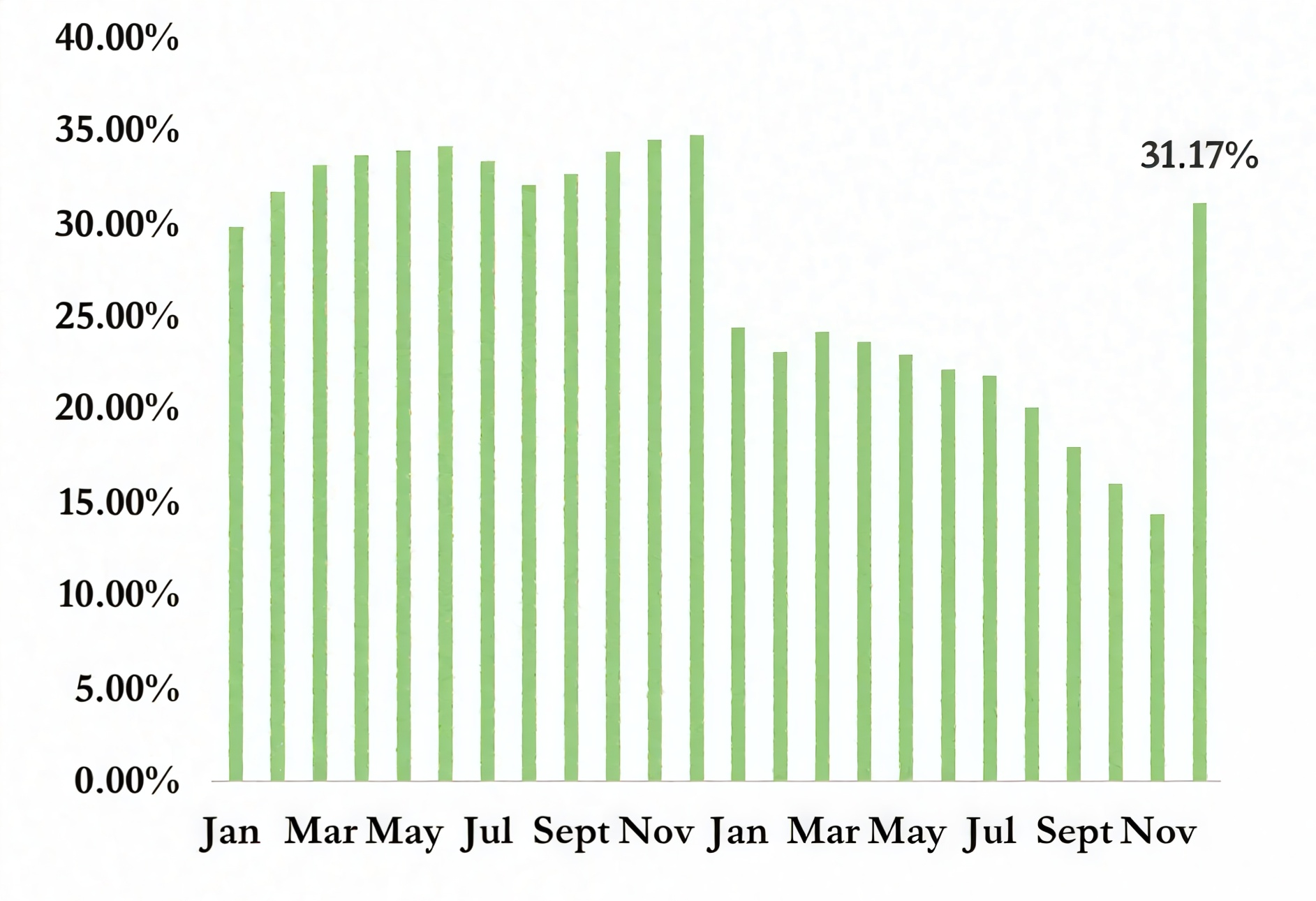

The decline follows the NBS’s adoption of a 12-month average CPI for 2024 as the reference period, replacing the previous single-month (December 2024) base. This change was implemented to eliminate an artificial inflation spike caused by base effects. Under the former methodology, headline inflation for December 2025 was projected to surge to about 31.2%, a distortion driven by the comparison base rather than a sharp acceleration in underlying price pressures. The revised approach, therefore, provides a more accurate representation of inflation dynamics, even as price levels remain elevated.

On a disaggregated basis, food inflation eased to 10.84% in December from 14.21% in November, while core inflation moderated to 18.63% from 20.59%, reflecting a broad based slowdown in price momentum following the methodological adjustment. On a month-on-month basis, headline inflation decelerated to 0.54%, down from 1.22% in the prior month. Food inflation turned negative at 0.36%, compared with 1.13% in November, suggesting easing short-term price pressures, while core inflation slowed to 0.58% from 1.28% previously.

OUTLOOK

We expect headline inflation to maintain a downward trajectory in 2026, supported by a relatively stable exchange rate, which should help moderate imported inflation pressures. Additionally, a weaker global oil market, driven by a projected supply surplus, could further ease global energy prices. However, this presents a double-edged risk: while lower energy prices may reduce domestic fuel costs and ease transportation and logistics expenses, weaker oil prices could also dampen export earnings and exert pressure on the naira, potentially offsetting gains through higher import costs.

On balance, the anticipated disinflation trend may create room for the Monetary Policy Committee to begin a gradual pivot away from its current hawkish stance, should macroeconomic conditions remain supportive.

Y-o-Y Inflation Trend New CPI Series

Y-o-Y Inflation Trend Old CPI Series

M-O-M Inflation Trend New CPI Series

- Report

Nigeria Economic Review

2025 Economic Review

Economic Growth Performance

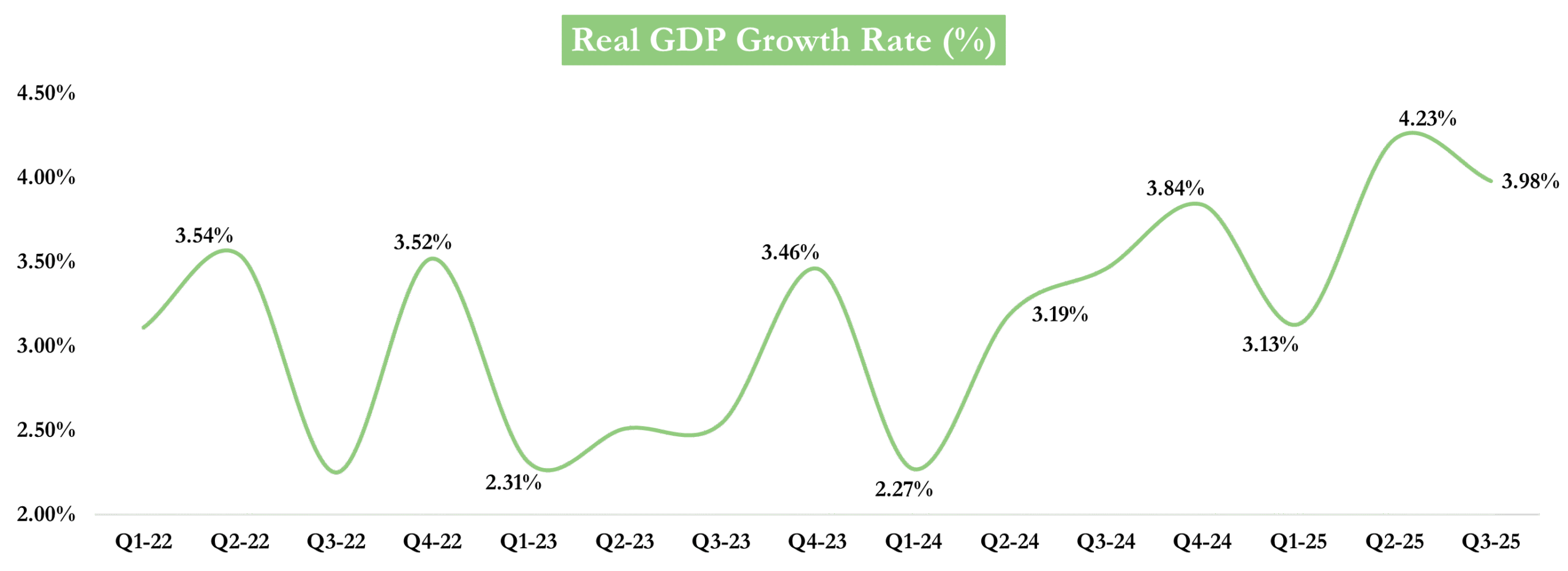

- Nigeria’s economy expanded by 3.98% y/y in Q3 2025, easing from 4.23% in Q2, its strongest growth since Q2 2021, but outperforming the 3.86% growth recorded in Q3 2024.

- The non-oil sector, which accounted for 96.6% of total output, grew by 3.91% vs Q2: 3.64%, supported by stronger activity in agriculture (3.79%), financial and insurance services (19.63%), trade (1.98%), construction (5.57%), and modest gains across ICT, real estate, and manufacturing.

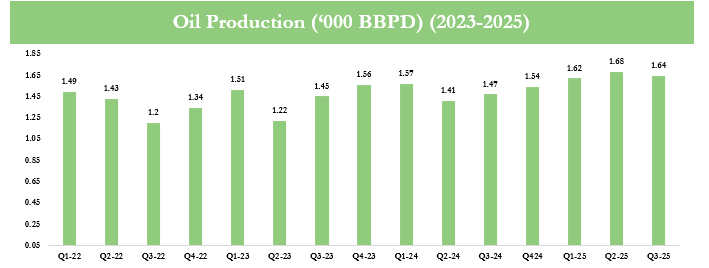

- In contrast, the oil sector grew by 5.84% y/y, a sharp slowdown from 20.46% in the previous quarter, reflecting weaker crude output. Oil production averaged 1.64 mbpd in Q3, slightly below Q2’s 1.68 mbpd but above the 1.47 mbpd recorded in Q3 2024.

Source: NBS, BRB Research

Inflation and Monetary Policy

- Nigeria’s inflation environment has continued to improve, with headline inflation easing for the eighth consecutive month and settling at 14.45% from 16.05% year-on-year in November 2025. The deceleration has been driven largely by the rebasing effect, softer food price pressures, improved supply conditions, and a more stable foreign-exchange market. Core inflation remains elevated at 18.04% while Food inflation moderated to 11.08%, reflecting a gradual easing in underlying price pressures.

- Against this backdrop, the Central Bank of Nigeria maintained the MPR at 27% in November 2025, following a 50-bps reduction in September, as it sought to consolidate recent progress on disinflation. Although headline inflation continued to moderate, the MPC noted that underlying price pressures remain elevated, warranting a cautious pause. The adjustment of the policy corridor to +50/-450 bps from +250/-250 bps signals a subtly more accommodative liquidity framework. The stance shows a gradual shift from aggressive tightening toward a more balanced macro-stabilization

Source: NBS, BRB Research Source: Investing.com, BRB Research

Exchange Rate and Foreign Reserves

- Nigeria’s foreign exchange market stabilized in 2025 following previous periods of sharp depreciation, supported by CBN initiatives including the Electronic FX Matching System (EFEMS), transparent auction processes, and partial market liberalization. These measures enhanced liquidity and narrowed the gap between official and parallel market rates, with the naira strengthening to ₦1,446 per US dollar by November 2025 from ₦1,535 per US dollar at the end of 2024.

- Foreign reserves rose from USD 40.2 billion at the end of 2024 to USD 44.67 billion by November 2025, reflecting strengthened external sector conditions. The recent Eurobond issuance of $2.35 billion provided a significant boost to reserve buffers, complementing gains from improved oil production, firmer export receipts, steady remittance inflows, and renewed foreign portfolio investment.

Oil Market

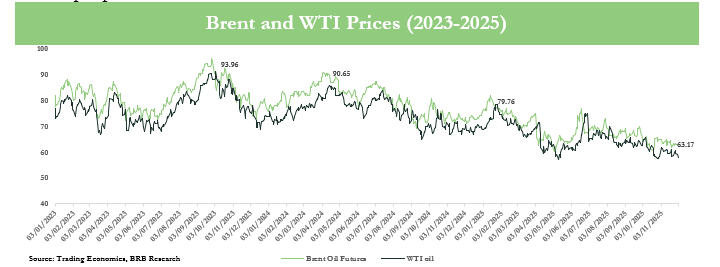

- The 2025 oil market began the year in relative balance, with temporary supply disruptions from seasonal factors and unplanned non-OPEC+ outages offset by robust structural supply. Demand growth remained moderate amid macroeconomic uncertainty, resulting in stable prices with limited volatility.

- In Q2, OPEC+ began rolling back voluntary production cuts while output from the U.S. and Brazil remained strong, leading to rising supply that outpaced demand and triggered bearish sentiment. By Q3, oversupply became the defining feature, as global production exceeded demand, inventories accumulated, and analysts revised downward full-year price expectations.

- The year closed with the supply glut persisting into Q4; inventories remained elevated, and prices stabilized below mid-year peaks following OPEC+ guidance on potential early-2026 output pauses.

Oil Production

- In Q3 2025, Nigeria’s average daily oil production stood at 1.64 million barrels, up 0.17 mbpd from Q3 2024 but slightly below Q2 2025’s 1.68 mbpd. The sector’s gradual recovery in 2025 was supported by improved security, enhanced pipeline integrity, and more coordinated upstream operations. Production averaged 1.66 mbpd in H1, peaked at 1.68 mbpd in Q2, the highest since 2020, and moderated slightly in Q3, reflecting ongoing operational adjustments and maintenance activities.

- The rebound helped reinforce external balances and foreign-exchange supply, but output volatility remained a feature of the sector’s performance. Despite the improvement, production levels fell short of the government’s 2025 target of 2.06 million barrels per day, reflecting ongoing structural challenges. Crude theft, infrastructure constraints, and intermittent operational disruptions continued to weigh on capacity utilization, limiting the pace of recovery.

Source: NBS, BRB Research

Economic Outlook for year 2026

2026 Outlook

- Nigeria’s economy is expected to expand over the near term, with the IMF projecting GDP growth of 3.9% in 2025 and 4.2% in 2026, supported by stable oil inflows, improving oil production levels, and greater policy consistency.

- Headline inflation is expected to continue its moderating trend in 2026, easing toward 11.56% by year-end, supported by a stable exchange rate, cautious monetary policy, and weaker energy prices. This disinflationary environment is likely to provide the Central Bank of Nigeria with scope to maintain a neutral to mildly accommodative monetary policy stance. We anticipate a potential recalibration of the MPR, with a projected easing of around 200 basis points by mid-2026, contingent on inflation remaining firmly anchored and underlying price pressures remaining subdued.

- Several risks could reverse the projected downward trend in inflation in 2026. Pressure on the exchange rate may increase the cost of imported goods, while elevated government spending ahead of elections could inject additional liquidity, boosting prices. Structural challenges, including insecurity in key food-producing regions, may constrain supply and exert upward pressure on food prices. External shocks, such as volatility in global oil markets, also represent a potential upside risk to inflation during the year.

- Despite these challenges, higher foreign reserve buffers and reforms in the foreign-exchange market, including enhanced transparency and more efficient EFEMS operations, should help limit exchange-rate volatility and strengthen overall broader macroeconomic stability. These developments, alongside easing inflation and relatively stable macro fundamentals, are likely to support investor sentiment and attract modest portfolio inflows over the course of the year.

- The macroeconomic environment nonetheless remains sensitive to external and domestic shocks. Oil-price volatility continues to pose the most significant risk to fiscal stability and FX supply, while uncertainty around the revised Capital Gains Tax framework and lingering security concerns may temper investor appetite in the near term. Even so, the broader environment suggests cautiously improving conditions for Nigeria’s asset management and investment industry in 2026.

- Global oil market dynamics will be pivotal for Nigeria in 2026, with a structural supply surplus expected to persist due to strong non-OPEC+ production from the U.S. and Brazil and a measured supply approach from OPEC+. Demand growth will remain concentrated in non-OECD Asia, while elevated inventories are likely to keep Brent crude in the mid-to-low $50s per barrel. A potential peace deal between Russia and Ukraine could further soften prices if sanctions on Russian oil are eased, adding additional barrels to the market. Although geopolitical disruptions could still trigger short-term volatility, sustained low prices may eventually dampen non-OPEC+ investment.

Equities Market Review

Nigeria Equities Market Performance 2025

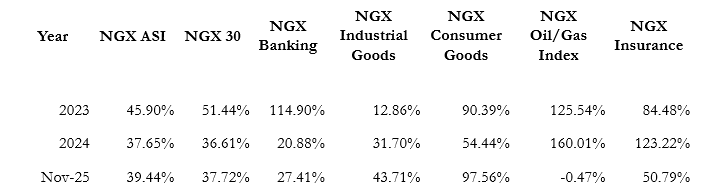

The Nigerian equity market delivered a powerful yet volatile performance in 2025, emerging as one of the strongest markets globally. For most of the year, sentiment was supported by market-friendly reforms, resilient corporate earnings, improved foreign-exchange conditions and strong domestic liquidity.

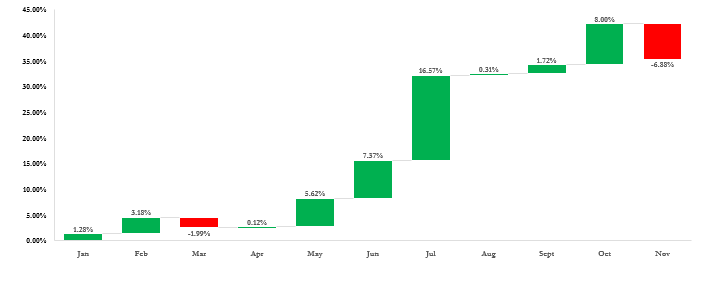

Market capitalization rose from ₦62.76 trillion at end-2024 to ₦91.29 trillion by late November, reflecting a 45.45% increase in investor wealth. Gains strengthened through the third quarter, with the ASI up 16.57% by mid-year and nearly 50% by October. The NGX All-Share Index (ASI) also advanced significantly, climbing from 102,926.40 points to over 150,000 points in October before moderating to 143,520.52 in November.

Investor participation was robust, driven by both domestic and foreign flows. Total transactions for the first eight months of the year rose by 99% to ₦6.92 trillion. Foreign portfolio inflows increased by 122% to ₦1.45 trillion, aided by improved FX liquidity and clearer exit conditions, whereas domestic investors contributed over ₦5.46 trillion, reinforcing their leadership in market activity. These flows were complemented by the performance of several high-growth stocks, with tickers like BetaGlass, MTN, Ellah Lakes, WEMA Bank, NCR, MBENEFIT, UACN, and ASO Savings delivering returns ranging between 100% and more than 500%, reflecting strong liquidity and high conviction in select counters.

NGX ASI Monthly Returns

Sector performance highlighted the breadth of the rally. Consumer goods companies led with over 100% year-to-date gains by October, supported by strong local production and pricing resilience amid FX constraints. The Insurance Index rose sharply on recapitalization expectations, while the Banking Index, though third in returns, remained the most actively traded, reflecting strong institutional interest. Industrial goods stocks also saw significant demand, whereas the Oil & Gas Index lagged for most of the year due to sector-specific challenges.

NGX Sectoral Performance (2023-2025)

However, the positive momentum was interrupted in November by the sharpest correction of the year. Market capitalization fell by about ₦6.54 trillion following uncertainty over the proposed changes to the Capital Gains Tax framework. The shift from a flat 10% rate to a progressive structure of up to 30% triggered aggressive profit-taking and capital repatriation by foreign investors. Combined with geopolitical concerns, the policy announcement dampened sentiment and illustrated how quickly fiscal decisions can offset months of progress driven by monetary reforms and FX stability.

2026 Outlook

Outlook

Building on a robust 2025, Nigeria’s equities market is poised for a strong 2026 performance, with potential total returns exceeding 30%, supported by ongoing reforms, macroeconomic stability, and stronger corporate earnings. Key growth drivers include continued sectoral diversification, with consumer goods, industrials, and financials expected to anchor performance, alongside rising dividends that enhance total shareholder returns.

Market sentiment will be increasingly shaped by company-specific fundamentals, with investors focusing on earnings quality, balance sheet strength, and cash-flow resilience. The anticipated listing of NNPC Limited and Dangote Refinery next year could serve as a major liquidity and valuation catalyst, attracting both domestic and foreign capital.

Further support is expected from positive macroeconomic factors, including easing inflation, stable interest rates, and an improved foreign-exchange environment, as well as regulatory clarity that strengthens investor confidence. Active portfolio management, diversification across high-quality sectors, and close monitoring of earnings, FX developments, and policy changes will remain essential to navigate potential volatility and capture upside opportunities.