Our Approach

Simplifying Wealth Management

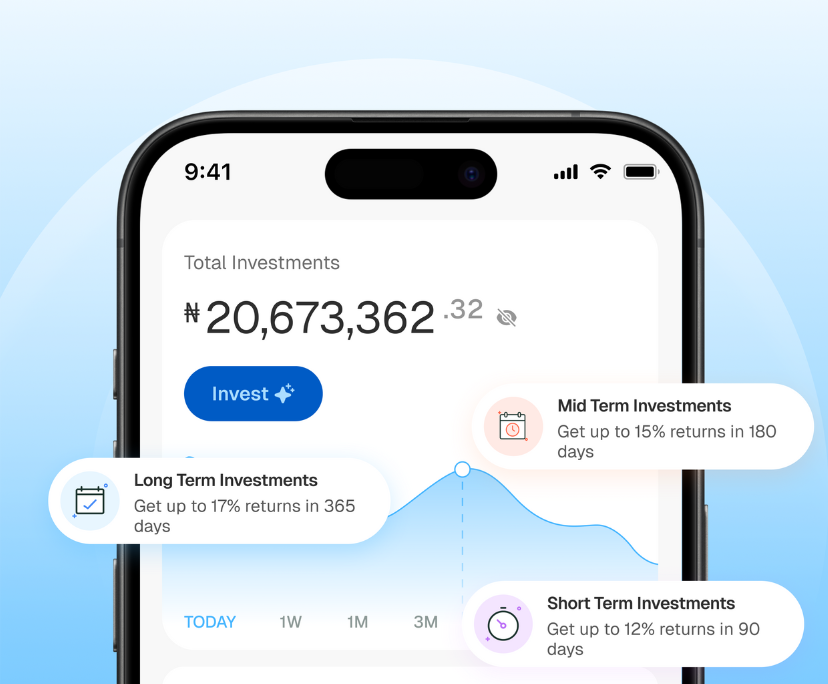

The Moneylot App is how we extend our approach beyond traditional fund management into a seamless digitized experience. It ensures inclusivity in wealth management by providing clients with a straightforward way of investing their funds. In simplifying this process, our clients can grow and manage their wealth with confidence, supported by the same values that guide everything we do at BRB Capital.

Traditional Fund Management

At BRB Financial Advisory Limited, our fund management approach is grounded in precision, discipline, and a deep understanding of both local and global markets. We believe that successful investing requires more than just capital, it demands a clear strategy, expert oversight, and continuous alignment with evolving financial goals.

We combine data-driven insights, active portfolio management, and rigorous risk analysis to deliver superior outcomes across various market conditions. Our clients benefit from a process that is structured, transparent, and tailored to their unique needs.

Client-Centered Strategy

We begin by understanding your goals, risk tolerance, and timeline, then build an investment strategy that fits, not a one size fits all model.

Disciplined Risk Management

Every portfolio is designed to balance growth with protection. We employ robust credit analysis, diversification, and market monitoring to manage downside risk.

Active Oversight & Market Responsiveness

Our fund managers constantly assess economic trends, rebalancing portfolios as needed to capture opportunities and guard against volatility.

Transparency & Accountability

As a tech-driven fund management firm, we empower our clients with the digital tools to keep them informed of their investment journey and make changes to their investment strategy

How Can Our Team Help You Reach Your Goals

Initial Consultation

We begin each relationship by understanding your objectives, covering timelines, liquidity needs, risk tolerance, and cross-border considerations for international investors.

Portfolio Setup

We use data driven research to craft portfolios that are bespoke to your financial needs.

Implementation

We proceed to execute your strategy with precision, ensuring regulatory compliance while providing visibility through our digital platforms.

Monitoring & Review

Our managers track markets closely, rebalancing portfolios to seize opportunities and reduce risks, while providing clients with regular reports and insights.

Updates & Support

We maintain open communication, offering global clients timely updates, performance discussions, and support.

See What Our Clients Are Saying

“BRB Capital didn’t just fund my business—they believed in the vision and walked the journey with me. BRB provided startup capital and strategic guidance that shaped the success of the business from the early stages of planning to the foundational steps of launching. Their commitment, insight, and genuine partnership have been instrumental, and I’m deeply grateful for their role in turning my ideas into a thriving enterprise.”

“Securing debt financing from BRB Capital was a game-changer for our healthcare financing business. It strengthened our working capital, enabling us to meet rising demand and expand strategically within the healthcare space. The competitive financing rate helped us optimize costs while scaling effectively. BRB Capital’s professionalism, efficiency, and deep understanding of our industry made the entire process seamless. We look forward to growing together.”

“Before BRB Capital, Juban Realty was just another small business trying to find its footing. For over four years, we operated passionately but lacked the structure and resources needed to scale. That changed when BRB Capital came into the picture. They believed in our vision, invested in our growth, and helped us build the structure that transformed our business. Today, Juban Realty is not just another real estate agency in Nigeria; we are a trusted brand, delivering value with confidence and clarity. BRB Capital didn’t just fund us; they empowered us.”