MPC RETAINS INTEREST RATE AMID DISINFLATIONARY TREND

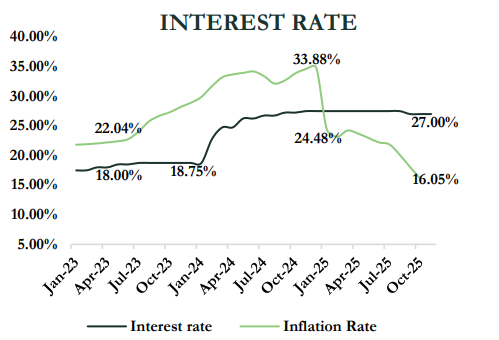

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria concluded its 303rd meeting on November 25, 2025, delivering a policy stance characterized by headline rate stability and technical tightening through adjustments to operational tools. While the benchmark rate was held constant, the recalibration of the asymmetric corridor signals a continued commitment to disinflation, FX stability, and prudent liquidity management.

Policy Decisions and Rationale

The MPC opted for continuity in its primary policy levers:

- MPR: Retained at 27.00%, reinforcing the CBN’s tight monetary posture.

- CRR: Maintained at 45% for DMBs, 16% for merchant banks, and 75% for non-TSA public sector deposits

- Liquidity Ratio: Held steady at 30%.

- Asymmetric corridor was adjusted to +50/-450bps from the previous +250/-250bps around the MPR

The most notable action was the adjustment of the asymmetric corridor to +50/-450 bps around the MPR, resulting in a 27.5% Standing Lending Facility (SLF) and a 22.5% Standing Deposit Facility (SDF). This shift away from the previously wider symmetric corridor effectively tightens the lower bound of system liquidity, discouraging excess reserves and strengthening monetary transmission. The Committee emphasized that maintaining this stance allows the lagged effects of earlier rate hikes to permeate the economy, given the ongoing disinflationary trend.

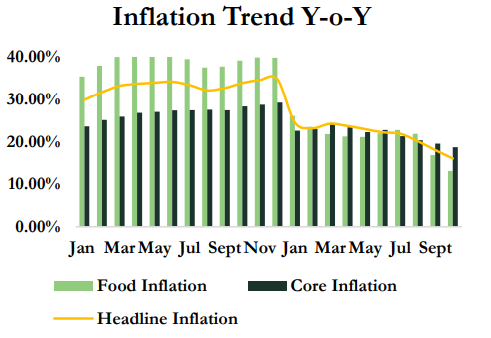

Inflation continued its steady downward trajectory in October 2025, marking the seventh consecutive month of disinflation. Headline inflation declined to 16.05% (y/y) from 18.02% in September, reflecting broad-based moderation across both food and core components.

Food inflation eased sharply to 13.12% from 16.87% in the previous month. This improvement was supported by improved domestic food supply associated with the seasonal harvest cycle, sustained exchange rate stability, and favourable base-year effects. Meanwhile, core inflation slowed to 18.69% (y/y) from 19.53%, driven largely by lower prices in furnishing and household maintenance categories.

Inflation Trend Y-o-Y

Despite these positive developments, the MPC emphasized that inflation remains elevated in double digits, underscoring the need for persistent policy vigilance to sustain and deepen the disinflation trend. The MPC noted that the broad-based deceleration across headline, food, and core measures reflects the combined effect of past tightening, exchange-rate stabilization, and improved domestic supply conditions. The Committee expects this disinflationary momentum to persist into the near term.

The MPC’s emphasis on persistently high core inflation, which remains above the headline rate, reinforces the view that underlying price pressures are structural rather than transitory. This validates the Committee’s cautious posture and signals that broad monetary easing will not commence until inflation expectations are firmly anchored and macroeconomic stability is consolidated.

The Global View

On the global front, the CBN assessed a cautiously improving environment. Global output is projected to strengthen on improved trade negotiations, accommodative policies in advanced economies, and easing geopolitical tensions. However, risks remain from potential protectionism, geoeconomic fragmentation, and renewed U.S.–China trade frictions. Global inflation is projected to continue moderating into 2026.

Domestically, the MPC highlighted the strong external sector position, supported by a surplus current account, continued reserve accretion, and Stable FX market conditions. These improvements, alongside collaborative fiscal–monetary reforms, supported recent upgrades to Nigeria’s sovereign rating and the country’s delisting from the FATF grey list, strengthening investor confidence.

Market Impact

The MPC’s decision to hold the MPR at 27% disrupted expectations for a sizeable rate cut, preventing the

significant yield compression previously anticipated across the money and bond markets. This outcome stabilizes fixed-income pricing by reducing immediate downside risk to asset values and provides clearer rate visibility after recent market volatility.

In the Treasury Bills and OMO segments, yields are expected to remain elevated. The latest auction results show the 364-day NTB marginal rate at 16.04%, broadly aligned with headline inflation at 16.05%. This ensures short-term instruments continue to deliver attractive real returns, supporting strong investor demand under the high-interest-rate environment.

From a portfolio positioning standpoint, the policy hold reinforces an Overweight bias toward short- to mid-tenor sovereign securities, where yields remain compelling and liquidity conditions tight. Demand for NTBs, OMOs, and 3–7-year FGN bonds is expected to stay robust, given banks’ need to manage liquidity under elevated CRR pressures and limited alternative outlets.

Equity market implications are mixed. A selective approach is warranted, emphasizing fundamentally strong, dividend-paying companies with sustainable pricing power. Large-cap banks are likely to maintain earnings resilience through elevated net interest margins, while firms with significant FX revenues stand to benefit from exchange-rate stability. Conversely, highly leveraged manufacturers and consumer-facing companies reliant on expensive domestic credit remain vulnerable under the prolonged tight monetary stance.

Outlook

The Committee projects that disinflation will continue in the near term, driven by the lagged effects of previous policy tightening, stable FX conditions, and improved domestic food supply associated with the seasonal harvest cycle. However, inflation remains elevated, and the MPC is expected to maintain a restrictive stance until a more durable decline in core and headline inflation is secured.

For financial markets, this suggests a continued environment of high yields, tight liquidity, and selective risk-taking. Fixed-income valuations will remain anchored by the elevated policy rate, while equity performance will diverge along sectoral and balance-sheet strengths.

The next MPC meeting is scheduled for February 23–24, 2026, where the trajectory of inflation, FX stability, and fiscal alignment will determine whether current tightening is sustained or provides room for cautious policy recalibration.